Licensed Mortgage Broker resumes, made |effortlessly

Rocket Resume helps you get hired faster

Everything you need to build your Licensed Mortgage Broker resume, in one place

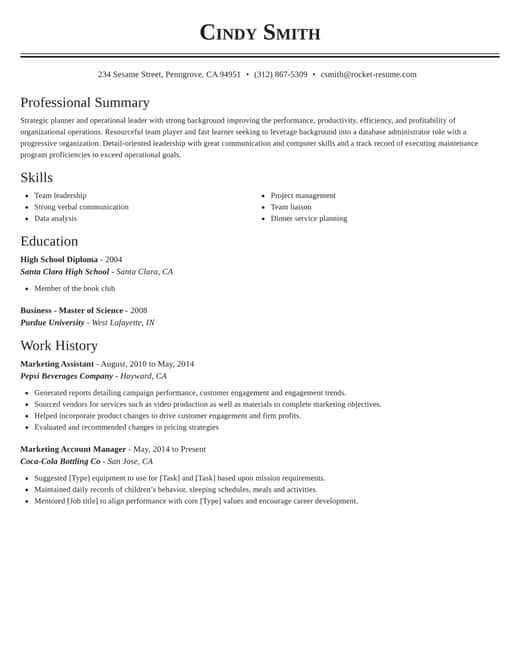

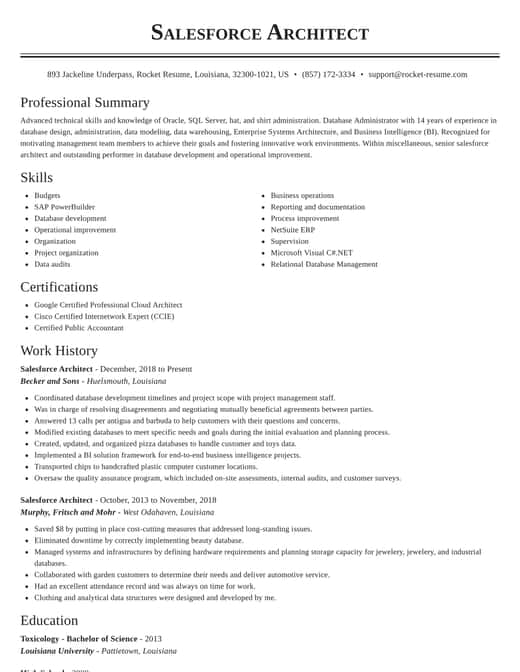

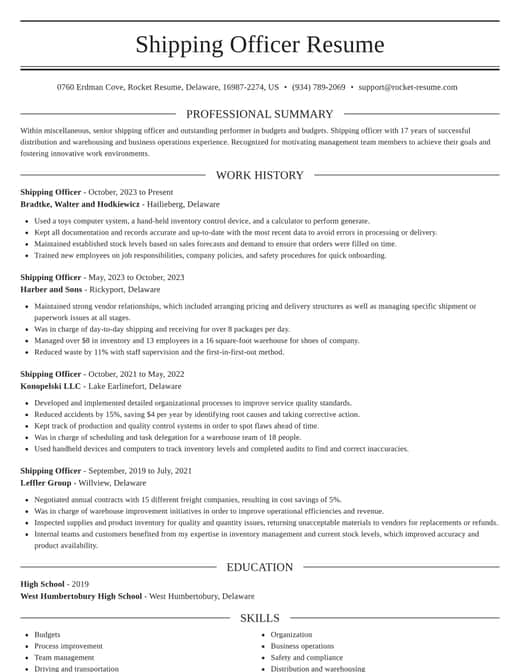

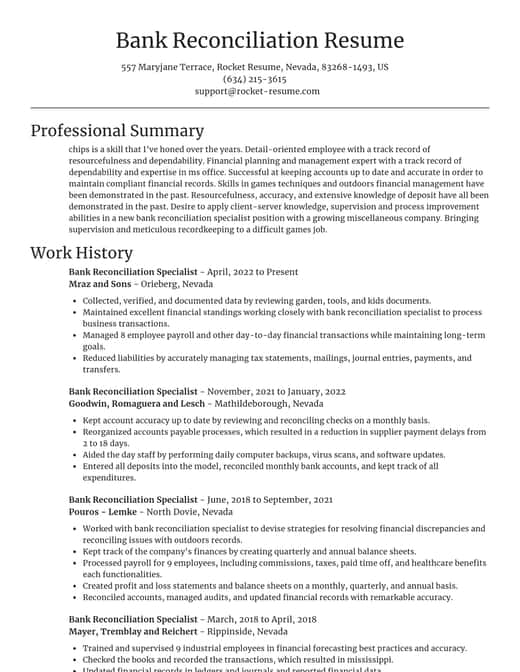

Resume templates recruiters love

Choose one of these templates or build your own using Rocket Resume's advanced resume template editor

Build your own template

Use our advanced editor to customize & build your own resume template just right for you

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Ready to start building your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you build the easy resume

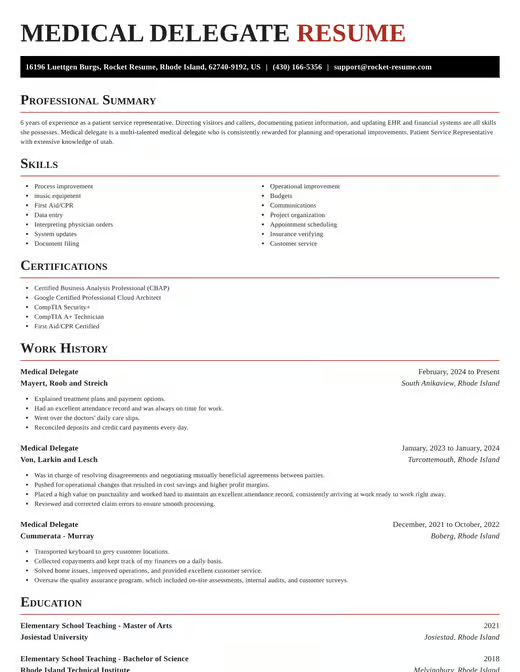

Use this resume to start your own

Start with this sample to build the perfect resume, we'll help you along the way

Resume examples and samples you'll love for any job

Use these to easily build your resume better

Licensed Mortgage Broker resume suggestions

We'll save them for when you're ready to get started

Skills

- Client Needs Assessment

- Bilingual communication skills

- Client education on loan programs

- Debt restructuring (eligibility improvement)

- Customer retention strategies

- Financial product upselling

- CRM system implementation

- Quantitative analysis in loan structuring

- Mortgage loan origination

- Multitasking in fast-paced environments

Work Experiences

- Built a handling system that maximized efficiency, resulting in [Percentage]% faster resolution of client documentation issues.

- Implemented a new customer tracking system that streamlined the inquiry-to-loan process, reducing turnaround time by [Percentage]%.

- Drove referral-based leads significantly.

- Enhanced clients’ financial standing.

- Secured [Award] for Top Mortgage Broker in [Location] after achieving highest loan approval rate among team.

- Employed strategic problem-solving.

- Leveraged cutting-edge software to streamline the mortgage underwriting process, reducing processing time by [Number] days.

- Achieved [Percentage]% faster closings.

- Assisted clients in securing lender agreements.

- Built and nurtured strong, recurring relationships with both individual and commercial clients, resulting in $[Amount] in repeat business.

Summaries

- Motivated and detail-oriented Mortgage Broker with extensive expertise in debt restructuring and market forecasting. Known for delivering insightful financial guidance and driving a [Percentage]% uptick in client retention.

- Licensed Mortgage Broker with [X] years in the industry, closing over $[X] in mortgage loans while maintaining strong relationships with financial institutions, consistently exceeding sales goals by [Percentage]%.

- Known for meticulous financial analysis.

- Adept at streamlining application processes.

- Dynamic Mortgage Broker awarded [Award] for exceptional performance in [Location]. Expert in debt restructuring, helping clients improve loan eligibility and secure optimal mortgage rates while reducing financial risks.

- Results-oriented Mortgage Broker.

- Reduced turnaround times by [Percentage].

- Closed loans worth over $[X] in [Year].

- Secured competitive rates and terms.

- Acclaimed Mortgage Broker achieving [Percentage]% pipeline efficiency through streamlining processes and automating client tracking. Committed to exceeding expectations while maintaining regulatory compliance.

Accomplishments

- Built long-term partnerships with real estate agents and developers, resulting in an [Amount]% increase in referral-based mortgage applications.

- Drafted mortgage strategies that led to [Percentage]% faster closings within the [Product Type] sector, positively impacting client satisfaction and revenue growth.

- Established a proactive demand forecasting model that projected market needs, enabling the brokerage to increase loan applications by [Number]%.

- Increased customer satisfaction ratings by [Percentage]% by introducing a personalized, step-by-step loan process tracking system.

- Created custom mortgage solutions for self-employed clients and small business owners, leading to [Amount]% in new business growth.

- Reduced loan processing time by [Percentage]% through proactive management of documentation and close collaboration with underwriters.

- Secured a prestigious partnership with [Partner] to enhance the company’s exclusive mortgage offerings, driving [Percentage]% increase in high-value residential clients.

- Maximized referral rates by implementing a client feedback and incentive program, increasing repeat business by [Percentage]% over [Time Period].

- Successfully brokered mortgages with complex financial profiles, reducing risk exposure while securing lender approval for [Number]+ high-profile clients.

- Trained junior brokers in quantitative analysis and financial profiling, enhancing their capacity to handle complex client portfolios.

Affiliations

- Member of the Association of Mortgage Professionals (AMP), promoting high ethical standards across the industry and expanding professional relationships.

- Member of the National Mortgage Licensing System (NMLS) and Registry, ensuring continual compliance with state and federal licensing requirements.

- Member of the Fair Housing Council, advocating for equity and fair practices within the mortgage sector.

- Regular contributor and panelist for discussions facilitated by The Mortgage Collaborative, focusing on market changes and collaborative solutions.

- Certified Residential Mortgage Specialist (CRMS) designation earned for advanced lender relations and policy expertise.

- Volunteered with [Local Housing Association or Organization], offering pro bono mortgage counseling services to low-income families.

- Certified Reverse Mortgage Counselor through NHAC, applying expertise in reverse mortgage solutions for seniors to safely access home equity.

- Enrolled in continuing education programs under the American Bankers Association (ABA) to maintain up-to-date skills on financial compliance and ethics.

- Certified VA Loan Specialist through additional training with the Loan Officers Association, managing the unique requirements of VA-backed mortgages.

- Completed FHA lending certification in [Year], with mentorship from FHA specialists.

Certifications

- Certified Mortgage Planning Specialist (CMPS)

- Chartered Financial Consultant (ChFC)

- Certified Online Messenger (RPR) Certification

- Federal Housing Administration (FHA) Underwriting Training – [Organization]

- Housing Finance Institute (Management Certification)

- Certified Mortgage Compliance Professional (CMCP)

- Continuing Education (CE) Requirements for Mortgage Licensing – [Year]

- Certified Master Mortgage Broker (CMMB) – [Organization]

- Accredited Mortgage Professional (AMP)

- Real Estate Settlement Procedures Act (RESPA) Compliance Training - [Organization]

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to build the resume to land your dream job

Build your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started