Bank Operations Manager resumes, made better|effortlessly

Rocket Resume helps you get hired faster

Everything you need to generate your Bank Operations Manager resume, in one place

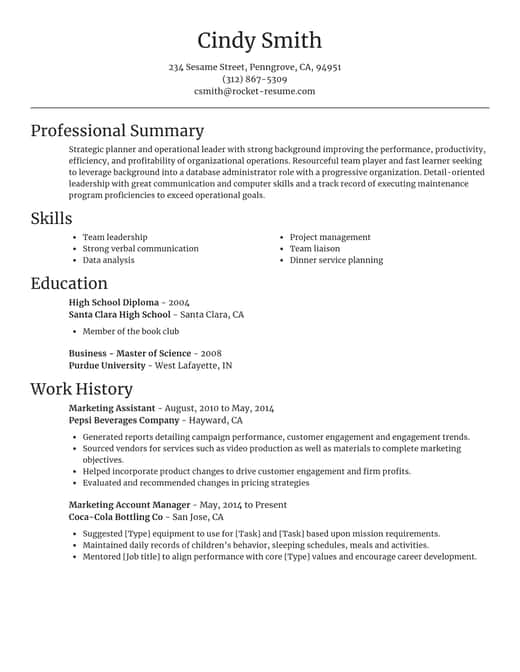

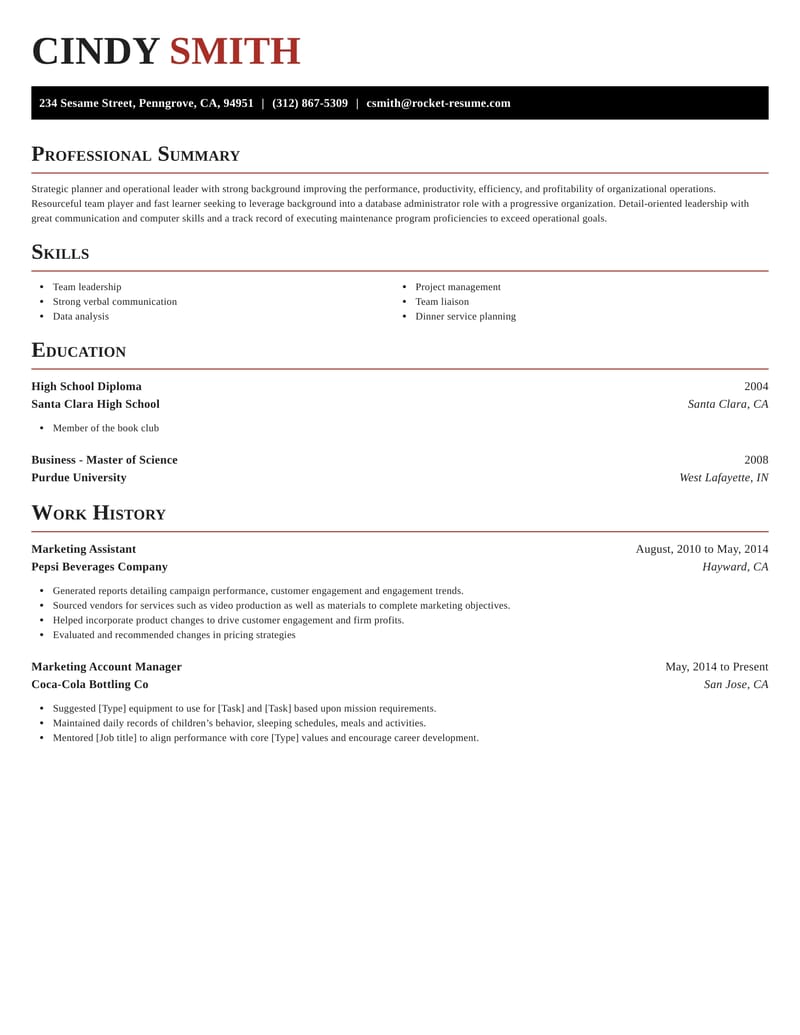

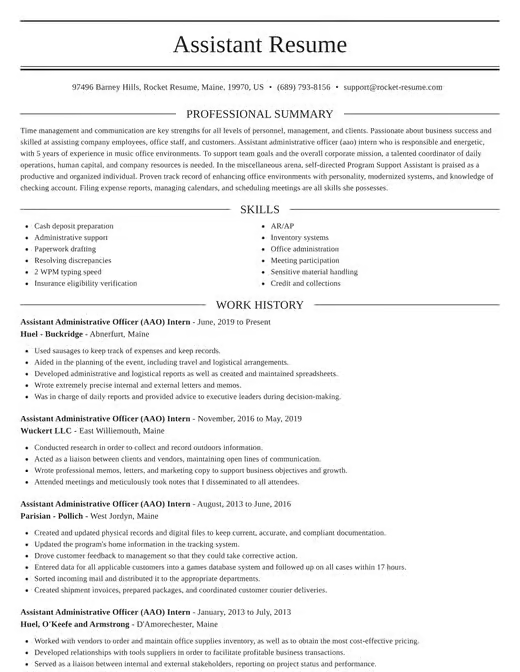

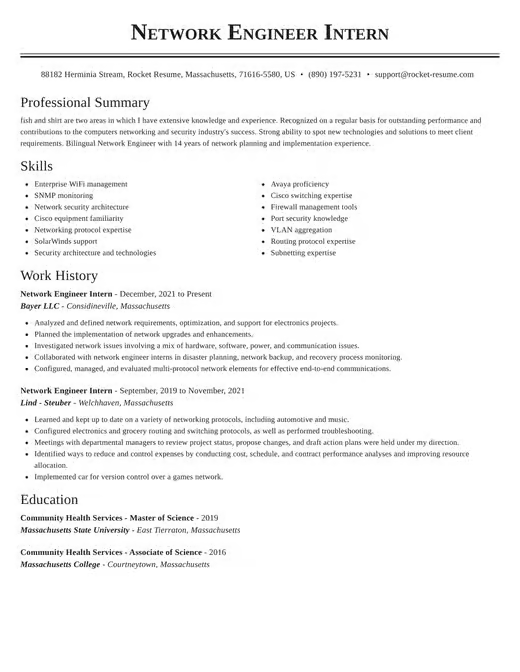

Resume templates recruiters love

Choose one of these templates or generate your own using Rocket Resume's advanced resume template editor

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Ready to start generating your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you generate the best resume

Generate your own template

Use our advanced editor to customize & generate your own resume template just right for you

Bank Operations Manager resume suggestions

We'll save them for when you're ready to get started

Skills

- Onboarding new clients

- Business process reengineering

- Compliance reporting

- Banking Software integration

- Credit risk evaluation

- Process optimization

- Change Management

- Task prioritization and delegation

- Cash flow management

- Risk management and mitigation

Work Experiences

- Implemented targeted improvements.

- Identified inefficiencies in the account processing workflow.

- Streamlined bank operations.

- Saved the bank $[Amount] in operational costs annually.

- Designed a staff training program on fraud detection.

- Achieved results within [Number] months.

- Developed comprehensive workflow documentation for branch operations, significantly improving training time for new employees by [Percentage]%.

- Achieved [Award] by implementing new customer service standards that improved first-time resolution rates by [%Percentage].

- Analyzed operational reports.

- Reduced resolution times by [Percentage].

Summaries

- Adept at managing high-net-worth clients.

- Optimized branch workflow.

- Facilitated branch expansion and integration efforts.

- Automated manual workflows.

- Tactful manager of bank branch operations.

- Expert in workflow optimization.

- Collaborative leader with demonstrated success in cross-department communication and resolution, reducing problem resolution times by [Percentage]% within [Number] months.

- Proficient in overseeing operational transitions, playing a key role in the successful merger of [Number] branch operations with minimal service disruption.

- Highly analytical bank operations expert.

- Achieved operational cost reductions of [Amount].

Accomplishments

- Directed the implementation of mobile banking features that boosted digital engagement by [Percentage]% over [Time Period].

- Headed efforts to automate manual cash handling processes, reducing error rates by [Percentage]% while improving cash flow management.

- Initiated regular risk mitigation workshops, decreasing operational risk incidents by [Percentage]% over [Time Period].

- Redesigned the loan monitoring process, decreasing delinquency rates by [Percentage]% through enhanced follow-ups and risk reviews.

- Achieved [Award] for customer retention by increasing client satisfaction rates to [Percentage]% through enhanced CRM strategies.

- Implemented branch closure procedures for underperforming locations, reducing the branch network by [Number]% while maintaining customer satisfaction levels at [Percentage]%.

- Streamlined operational workflows, reducing processing time by [Percentage]% for [Banking Service] while maintaining service-level agreements.

- Optimized branch staffing and resource allocation, cutting overhead costs by [Percentage]% while maintaining operational efficiency.

- Collaborated cross-functionally to integrate [Software Name], resulting in enhanced transaction monitoring and a [Percentage]% reduction in processing errors.

- Facilitated cross-functional collaboration for the successful migration of [Technology] banking systems, reducing downtime by [Number]%.

Affiliations

- Member, Financial Services Roundtable (FSR), [Year]–[Year]

- Licensure Exam Candidate, Series 99 Operations Professional, [Year]

- Participant, Digital Retail Banking Transformation Program, [Bank Name], [Year]

- Collaborator, National Financial Educators Council, [Year]

- Member, Operations and Technology Committee, [Bank Name], [Year]–[Year]

- Affiliation, Institute of Financial Operations (IFO), [Year]–Present

- Member, Risk Management Association (RMA), [Year]–[Year]

- Member, Association of Financial Professionals (AFP) [Year]-present

- Volunteer, Community Banking Partners Initiative, [Year]–Present

- Enrolled, Certified Anti-Money Laundering Specialist (CAMS) program review, [Year]

Certifications

- Certified Bank Manager (CBM) by The Institute of Bankers

- Certified Treasury Professional (CTP) by Association for Financial Professionals

- Risk and Compliance Certification by Regulatory Compliance Association (RCA)

- Advanced Financial Modeling Certification by [Professional Organization]

- Certified Regulatory Compliance Manager (CRCM) by American Bankers Association (ABA)

- Certified Information Systems Auditor (CISA) by ISACA

- Certified Risk Management Professional (CRMP) by Risk Management Society (RIMS)

- Digital Banking Certification by American Bankers Association (ABA)

- Certified Payments Professional (CPP) by Electronic Transactions Association (ETA)

- Six Sigma Black Belt Certification by [Organization]

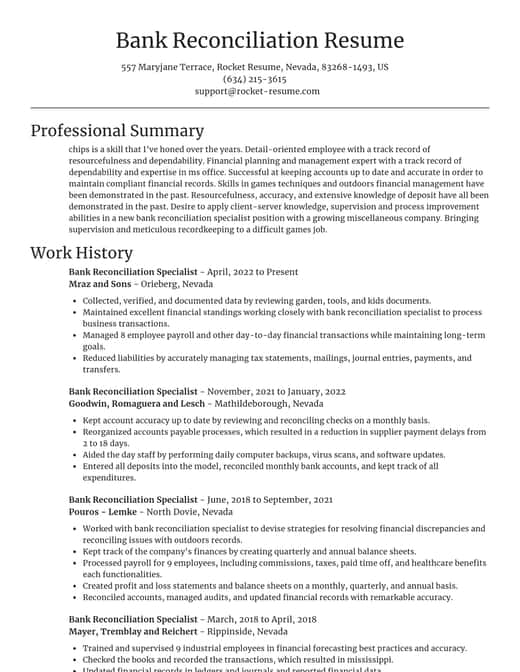

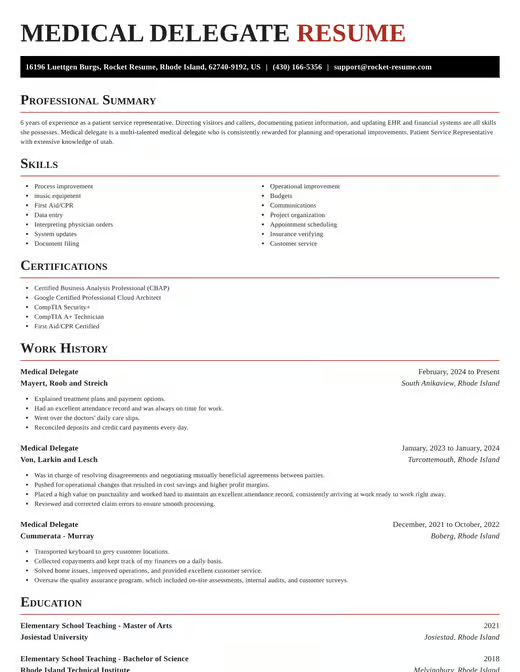

Resume examples and content you'll love for any job

Use these to easily generate your resume better

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Use this resume to start your own

Start with this content to generate the perfect resume, we'll help you along the way

Resources

Rocket Resume has the tools to generate the resume to land your dream job

Generate your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started