Senior Loan Specialist resumes, made better|effortlessly

Rocket Resume helps you get hired faster

Everything you need to build your Senior Loan Specialist resume, in one place

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

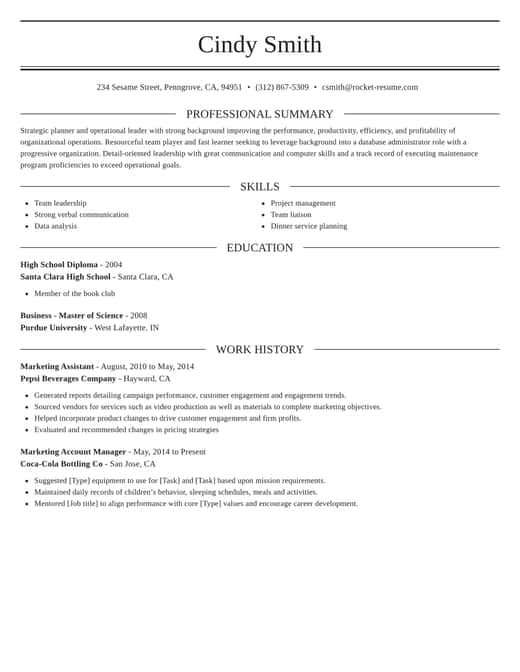

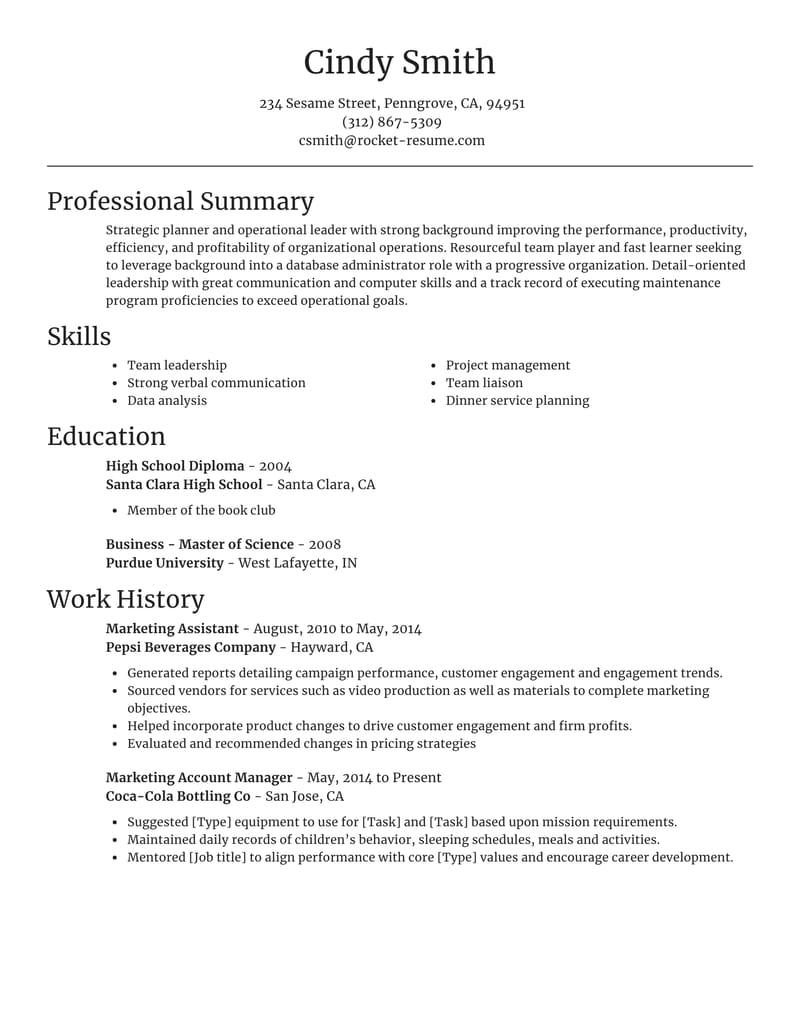

Resume templates recruiters love

Choose one of these templates or build your own using Rocket Resume's advanced resume template editor

Build your own template

Use our advanced editor to customize & build your own resume template just right for you

Ready to start building your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you build the easy resume

Resume examples and templates you'll love for any job

Use these to easily build your resume better

Use this resume to start your own

Start with this template to build the perfect resume, we'll help you along the way

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Senior Loan Specialist resume suggestions

We'll save them for when you're ready to get started

Skills

- Fraud Detection and Prevention

- Loan portfolio management

- Financial risk mitigation

- Commercial loan origination

- Credit underwriting coordination

- Corporate loan administration

- Bilingual proficiency in [Language]

- Financial statement analysis

- Data-driven decision making

- Client portfolio expansion

Work Experiences

Summaries

- Streamlined processes.

- Maintained stringent regulatory compliance.

- Passionate about customer satisfaction.

- Aligned lending practices with business growth.

- Bolstered client portfolios.

- Drove year-over-year growth by [Percentage]%.

- Comprehensive knowledge of loan structuring.

- Passionate Senior Loan Specialist.

- Adept at client relationship management.

- Senior Loan Specialist with strong leadership in team development, mentoring a team of [Number] junior loan officers to achieve collective success. Passionate about fostering a collaborative high-performance culture.

Accomplishments

- Trained and mentored a team of [Number] junior loan officers, improving team performance by [Percentage]% in key performance metrics such as loan closures and client satisfaction.

- Coordinated complex loan restructuring initiatives that resulted in the successful closure of [Number] deals, directly enhancing the company’s net loan book by $[Amount].

- Utilized advanced loan assessment tools to decrease processing time by [Percentage]% while raising approval accuracy for high-value loans.

- Increased client's borrowing capacity by $[Amount] by recommending strategic refinancing options while maintaining a risk-averse position.

- Regularly achieved risk-adjusted returns above [Percentage]%, bolstering the profitability of the loan book by $[Amount] within [Year].

- Spearheaded a project that introduced digital loan applications, increasing application submissions by [Percentage]% and improving processing efficiency.

- Automated parts of the loan underwriting process, optimizing workflows and reducing lead-to-loan approval time by [Percentage]%.

- Regularly contributed to team goals, exceeding origination targets by an average of [Percentage]% over [Number] consecutive quarters.

- Led due diligence efforts that resulted in the approval of a $[Amount] loan to support working capital for a client in the [Industry] industry.

- Collaborated cross-functionally with internal risk teams to integrate AI-powered solutions that reduced loan processing time by [Percentage]%.

Affiliations

- Association of Government Accountants (AGA)

- Credit Union National Association (CUNA)

- National Association of Mortgage Brokers (NAMB)

- Commercial Finance Association (CFA)

- Certified Mortgage Banker (CMB) Program

- Women in Housing & Finance (WHF)

- National Association for Business Economics (NABE)

- Risk Management Association (RMA)

- Association of Financial Professionals (AFP)

- Society of Industrial and Office Realtors (SIOR)

Certifications

- Accredited Mortgage Professional (AMP) by Mortgage Bankers Association

- Commercial Real Estate Analysis and Investment by MIT OpenCourseWare

- Certified Commercial Loan Specialist (CCLS) by [Organization]

- Certified Balance Sheet Manager (CBSM) by [Organization]

- Retail and Commercial Loan Documentation by [Institution]

- Advanced Credit Analysis Certification by Moody’s Analytics

- Certified Credit Risk Manager (CRM) by Global Risk Management Institute

- FHA Direct Endorsement Underwriter (DE) Certification by HUD

- Certified Mortgage Banker (CMB) by [Mortgage Bankers Association]

- Certified Anti-Money Laundering Specialist (CAMS) by ACAMS

Resources

Rocket Resume has the tools to build the resume to land your dream job

Build your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started