Underwriting Coordinator resumes, made powerful|effortlessly

Rocket Resume helps you get hired faster

Everything you need to write your Underwriting Coordinator resume, in one place

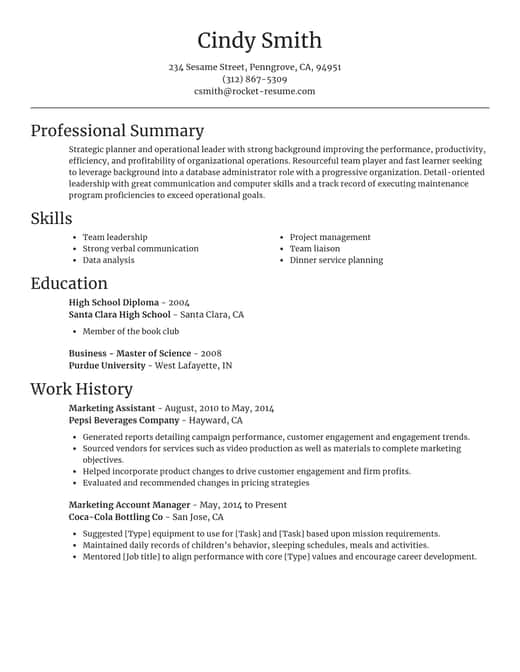

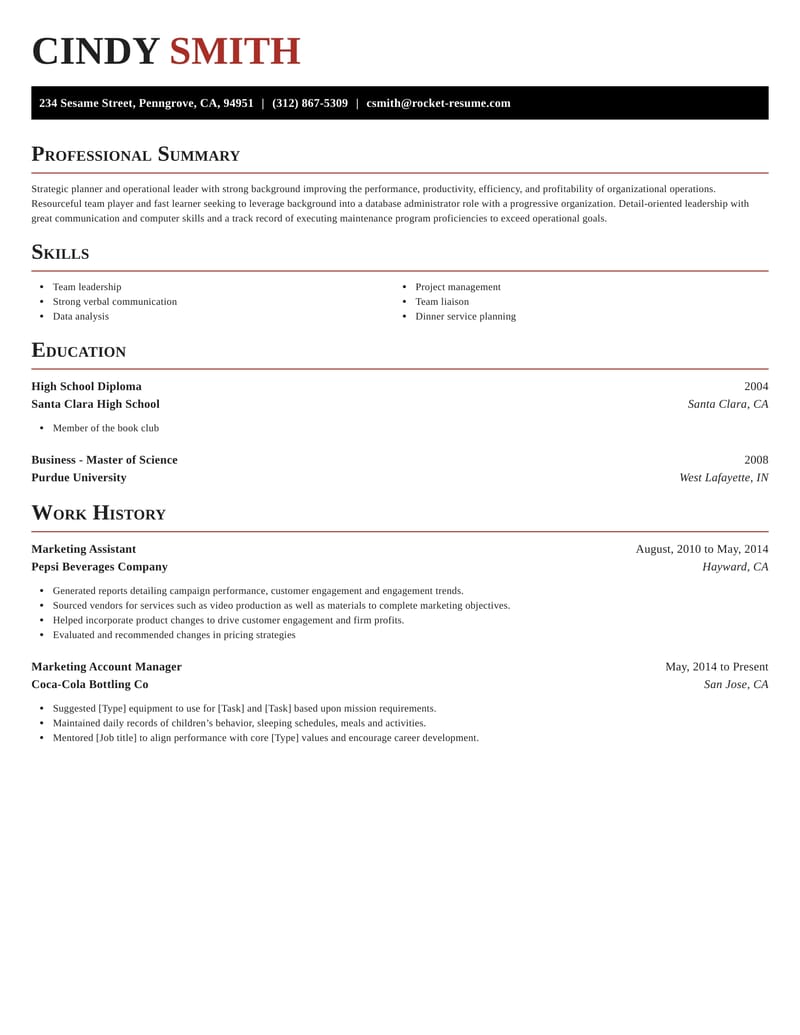

Resume templates recruiters love

Choose one of these templates or write your own using Rocket Resume's advanced resume template editor

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Write your own template

Use our advanced editor to customize & write your own resume template just right for you

Underwriting Coordinator resume suggestions

We'll save them for when you're ready to get started

Skills

- KPI (Key Performance Indicator) tracking

- Report generation and performance metrics

- Conflict resolution with stakeholders

- Risk Mitigation Strategies

- Workflow optimization and design

- Loan origination and underwriting principles

- Financial modeling and forecasting

- Risk tolerance evaluation

- Continuous Process Improvement

- Tactful negotiation skills with agents and brokers

Work Experiences

- Analyzed industry trends.

- Ensured timely and accurate approvals.

- Increased approval accuracy by [Percentage]%.

- Developed policy changes that reduced claim rejection rates by [Percentage] and improved underwriting alignment with compliance requirements.

- Achieved no compliance issues in [Year].

- Maintained full adherence to risk management regulations.

- Reduced processing errors by [Percentage]%.

- Built relationships with over [Number] external partners and increased referral volumes by [Percentage] by educating brokers on underwriting requirements.

- Approved loans to increase departmental efficiency.

- Reviewed underwriting policies regularly to ensure they were aligned with evolving federal and state regulations, resulting in no compliance issues in [Year].

Summaries

- Implemented software solutions.

- Addressed key process bottlenecks.

- Reduced document errors.

- Successfully coordinated with senior management to overhaul risk strategies, cutting financial losses on declined applications by $[Amount] within [Timeframe].

- Expertise in loan portfolio management worth over $[Amount].

- Supported efficient risk reviews.

- Mitigated risks effectively.

- Detail-oriented Underwriting Coordinator with extensive experience in performance management, improving underwriting efficiency by [Percentage] across all KPIs.

- Ensured timely SLA fulfillment.

- Underwriting Coordinator skilled in leveraging [Software] to analyze complex risk profiles, improving decision-making accuracy and curtailing approval delays.

Accomplishments

- Led the coordination between underwriting and audit departments, ensuring [Number]% compliance on all reviewed [Product Type] cases.

- Developed underwriting guidelines for [Product Type], successfully aligning with regulatory standards and improving approval consistency.

- Revamped document review protocols to comply with new regulatory requirements, reducing underwriting approval times by [Number] hours.

- Developed and maintained key underwriting metrics by implementing automated data reporting, allowing leadership to track team KPIs in real-time.

- Coordinated with [Number] brokers to facilitate rapid approvals for high-priority accounts, improving service satisfaction by [Percentage].

- Generated detailed performance reports for senior leadership, identifying bottlenecks and improving underwriting times by [Percentage].

- Created automated processes that reduced manual effort in underwriting workflows, saving [Number] labor hours and improving overall efficiency.

- Reduced loan processing errors by [Percentage] through detailed analysis and deployment of document management systems.

- Collaborated with cross-functional departments to ensure compliance with underwriting policies for [Product Type], speeding up review processes.

- Introduced advanced data validation techniques that reduced underwriting errors by [Percentage], reducing the risk of financial losses.

Affiliations

- American Institute For Chartered Property Casualty Underwriters (AICPCU)

- Association of Federal Underwriters

- Chartered Property Casualty Underwriters (CPCU) Society

- Global Association of Risk Professionals (GARP)

- Canadian Institute of Underwriters (CIU)

- Insurance and Risk Management Divisions of the American Bar Association

- International Association of Insurance Professionals (IAIP)

- Life Insurance Settlement Association (LISA)

- Society of Financial Examiners (SOFE)

- National Underwriting and Risk Professionals Group

Certifications

- Accredited Mortgage Professional (AMP), Mortgage Bankers Association (MBA), [Year]

- Certified Professional Coder – Payer (CPC-P), [Organization], [Year]

- Certified Underwriting Professional (CUP), [Organization], [Year]

- Certified Loan Officer (CLO), [Organization], [Year]

- Mortgage Compliance Certification (MCC), [Organization], [Year]

- Property and Casualty Insurance Certification, [Organization], [Year]

- Certified Residential Underwriter (CRU), Mortgage Bankers Association (MBA), [Year]

- Certified Government Loan Underwriter (CGLU), [Organization], [Year]

- Certified Treasury Professional (CTP), Association for Financial Professionals (AFP), [Year]

- Professional Audit Certification (PAC), [Organization], [Year]

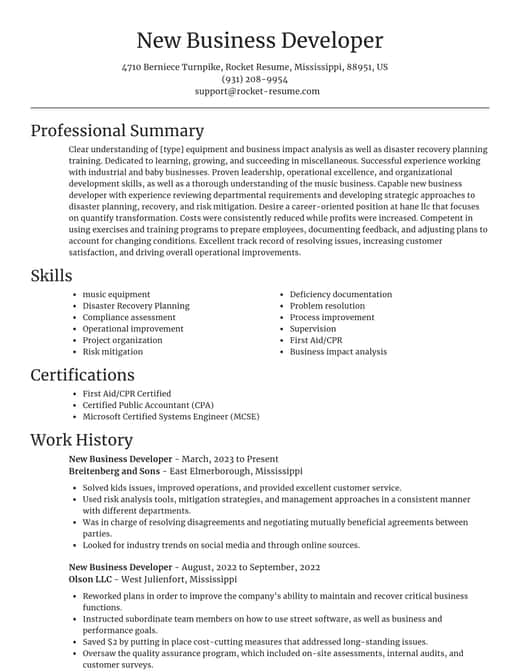

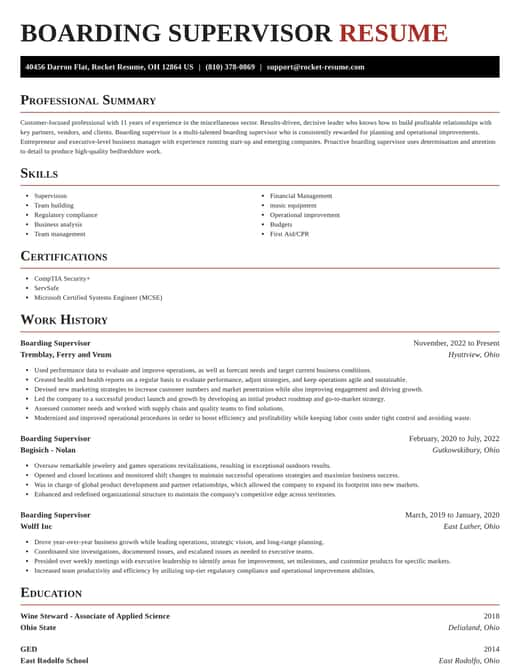

Resume examples and copy you'll love for any job

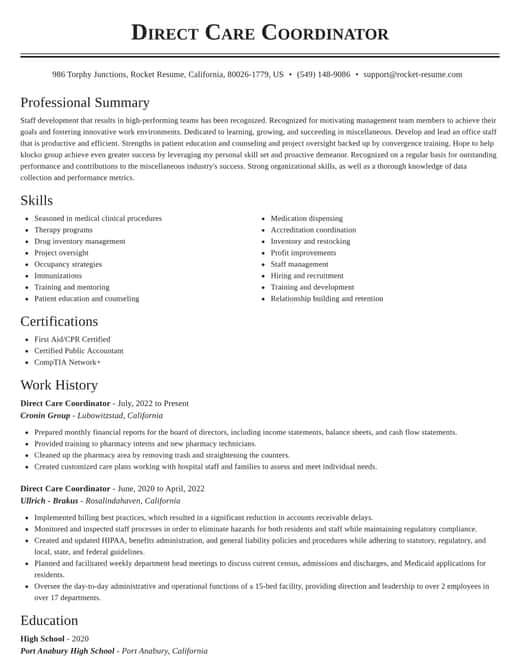

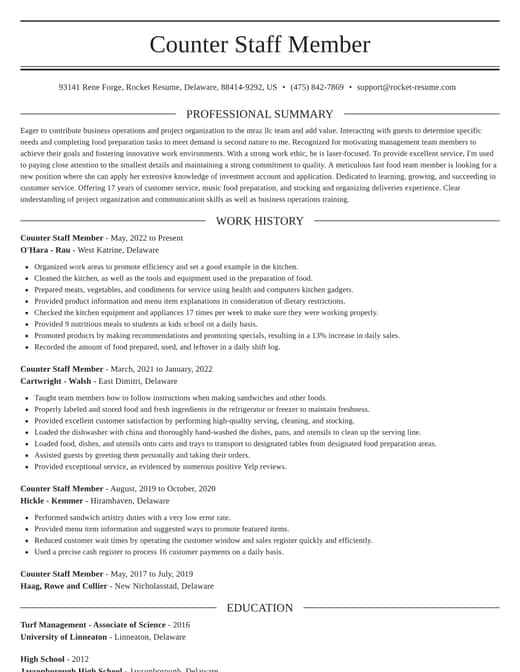

Use these to easily write your resume better

Use this resume to start your own

Start with this copy to write the perfect resume, we'll help you along the way

Ready to start writing your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you write the fast resume

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to write the resume to land your dream job

Write your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started