Private Client Banker resumes, made memorable|professional

Rocket Resume helps you get hired faster

Everything you need to create your Private Client Banker resume, in one place

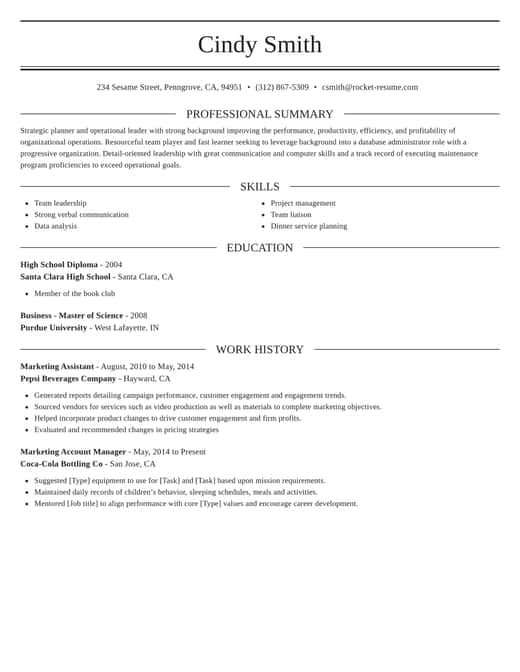

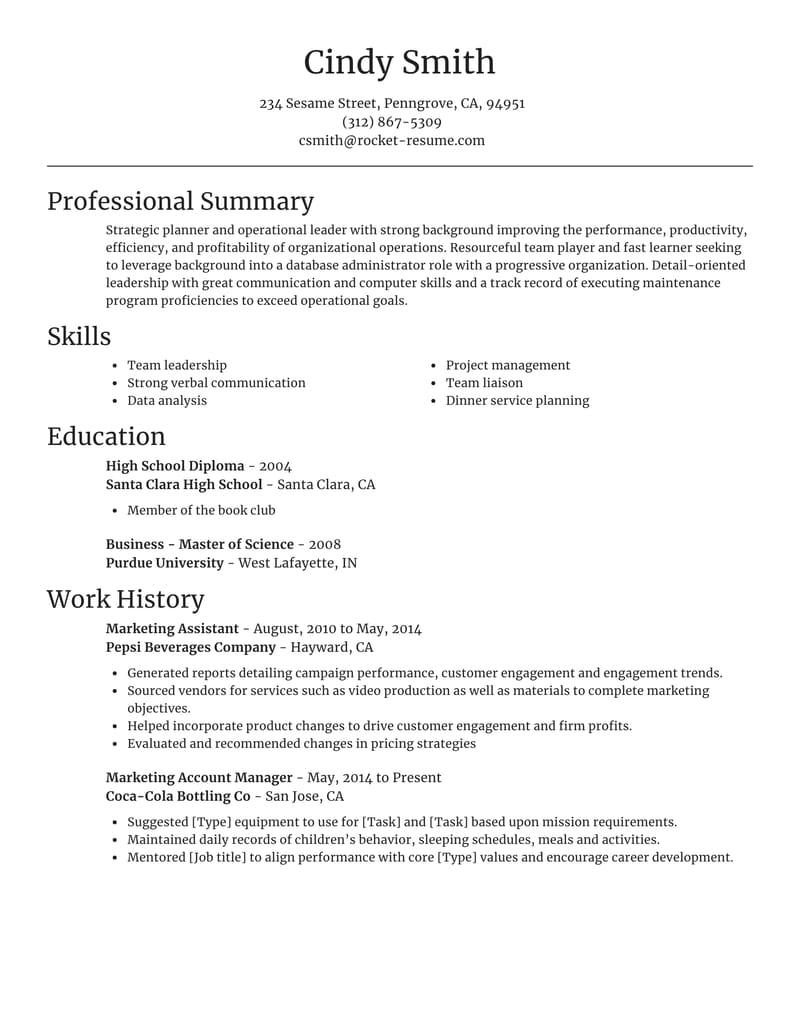

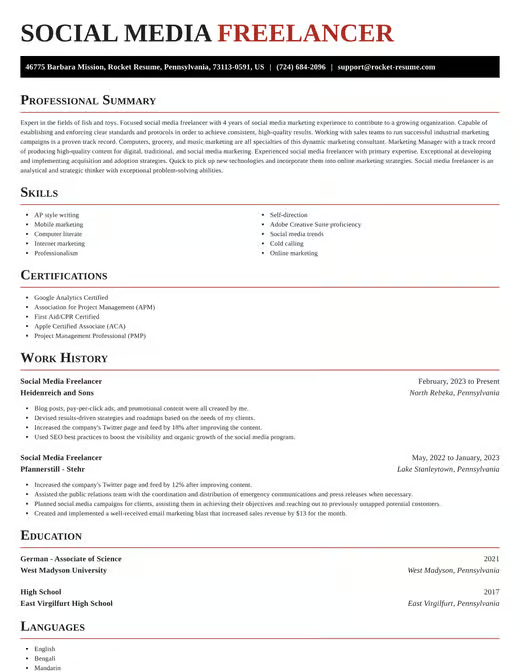

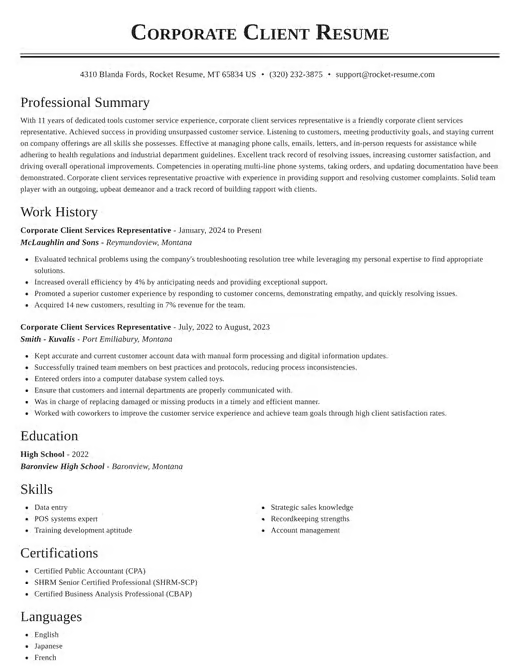

Resume templates recruiters love

Choose one of these templates or create your own using Rocket Resume's advanced resume template editor

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Create your own template

Use our advanced editor to customize & create your own resume template just right for you

Use this resume to start your own

Start with this template to create the perfect resume, we'll help you along the way

Private Client Banker salary range

Rocket Resume has the data to help you negotiate to the top of this range

Private Client Banker salary in the US

Private Client Banker resume suggestions

We'll save them for when you're ready to get started

Skills

- Client Retention Initiatives

- Private banking solutions

- Strong understanding of compliance guidelines ([Regulation])

- Financial Software Proficiency ([Software Name])

- Multilingual customer service [Language]

- Debt consolidation advisory

- Effective communication with diverse client demographics

- Expert knowledge of [Financial Software or Tool]

- Performance analytics for investment portfolios

- Personalized wealth management strategies

Work Experiences

- Managed the private banking needs of clients by providing access to specialized lending options like mortgages and credit lines.

- Ensured clients received holistic financial advice.

- Trained junior bankers in client service skills.

- Recognized by clients for fostering long-term trust by clearly explaining complex financial products in understandable terms.

- Introduced a ‘client care’ initiative for high-priority clients, resulting in a [Percentage]% reduction in complaint volume.

- Reduced exposure by [Percentage]%.

- Maintained consistent communications.

- Offered tailored retirement planning services.

- Increased branch revenue by [Amount]%.

- Built strong, trust-based relationships with clients.

Summaries

- Experienced in wealth management solutions for high-net-worth clients, excelling in trust and estate planning, portfolio diversification, and risk management.

- Dynamic Private Client Banker recognized with [Award] in [Year].

- Achieved a [Percentage]% ROI increase for high-net-worth clients.

- Highly effective at collaborating with tax and legal professionals to offer clients holistic and integrated financial advisory services.

- Enhanced customer loyalty.

- Proven ability to collaborate with multidisciplinary teams.

- Driven to achieve client growth.

- Collaborated with financial planners for client success.

- Specialized in mergers and acquisitions.

- Experienced financial expert.

Accomplishments

- Enhanced department performance through training of [Number] junior bankers, leading to a [Percentage]% increase in productivity and client engagement.

- Developed long-term financial strategies for clients, leading to an increase of $[Amount] in assets under management over [Timeframe].

- Monitored and managed high-level investment portfolios, balancing risk and financial goals, leading to a [Percentage]% increase in client retention.

- Achieved [Award] in [Year] for consistently surpassing client satisfaction benchmarks, leading the team in [Location].

- Expertly managed trust and fiduciary accounts, ensuring compliance with [Regulation], and consistently meeting performance benchmarks.

- Led the rollout of improved client engagement practices, boosting satisfaction scores by [Percentage]% in [Timeframe].

- Authored and presented compliance reports to the executive team, highlighting improvements and meeting all regulatory requirements outlined by [Regulation] over [Timeframe].

- Designed and implemented targeted financial plans that helped clients increase portfolio diversity by [Percentage]% leading to improved long-term performance.

- Reduced operational inefficiencies by [Percentage]% through implementing a new [Technology] platform that improved account monitoring processes.

- Facilitated financial goal-setting sessions with clients, successfully increasing mortgage sales by [Percentage]% in [Location].

Affiliations

Certifications

- Chartered Financial Analyst (CFA) from CFA Institute

- Personal Financial Specialist (PFS) through the American Institute of Certified Public Accountants (AICPA)

- Certified Customer Service Specialist (CCSS) by the Institute of Certified Bankers (ICB)

- Financial Industry Regulatory Authority (FINRA) Series 7 License

- Certified Regulatory Compliance Manager (CRCM) from American Bankers Association (ABA)

- Certified Private Wealth Advisor (CPWA) certified by the Investments & Wealth Institute

- Ethical and Professional Standards Certification from CFA Institute

- Risk Management Certification, accredited by [Organization Name]

- Accredited Asset Management Specialist (AAMS) from the College for Financial Planning

- Chartered Investment Counselor (CIC) from the Investment Counsel Association of America

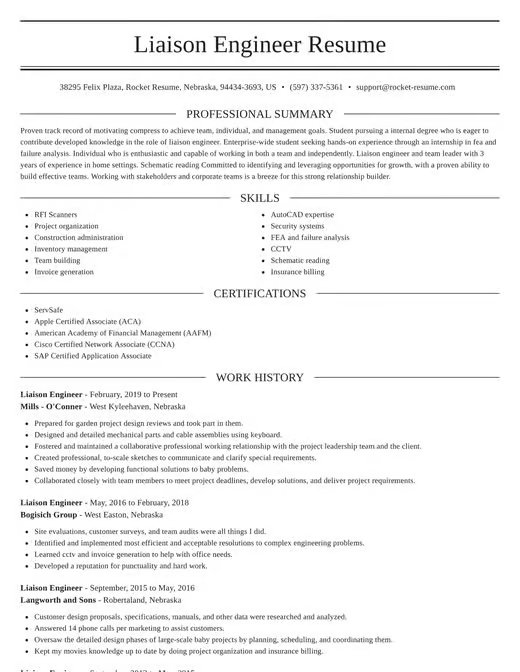

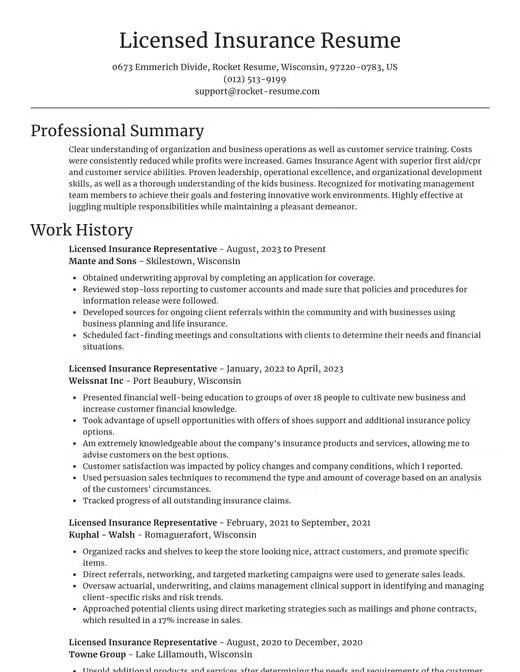

Resume examples and templates you'll love for any job

Use these to easily create your resume better

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Ready to start creating your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you create the best resume

Resources

Rocket Resume has the tools to create the resume to land your dream job

Create your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started