Call Center Personal Banker resumes, made memorable|effortlessly

Rocket Resume helps you get hired faster

Everything you need to build your Call Center Personal Banker resume, in one place

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

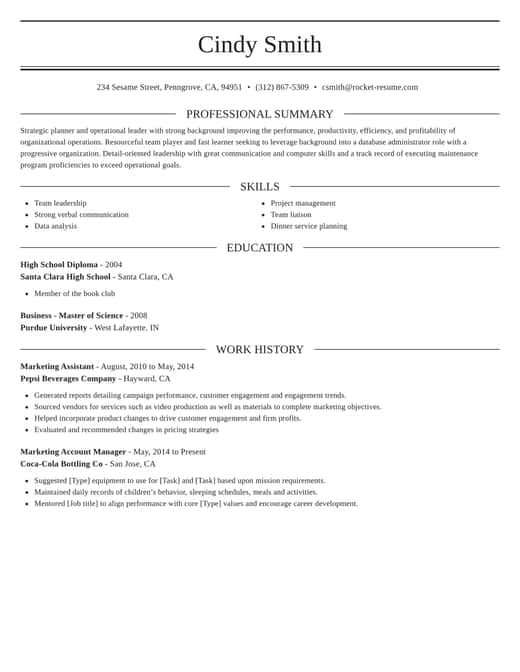

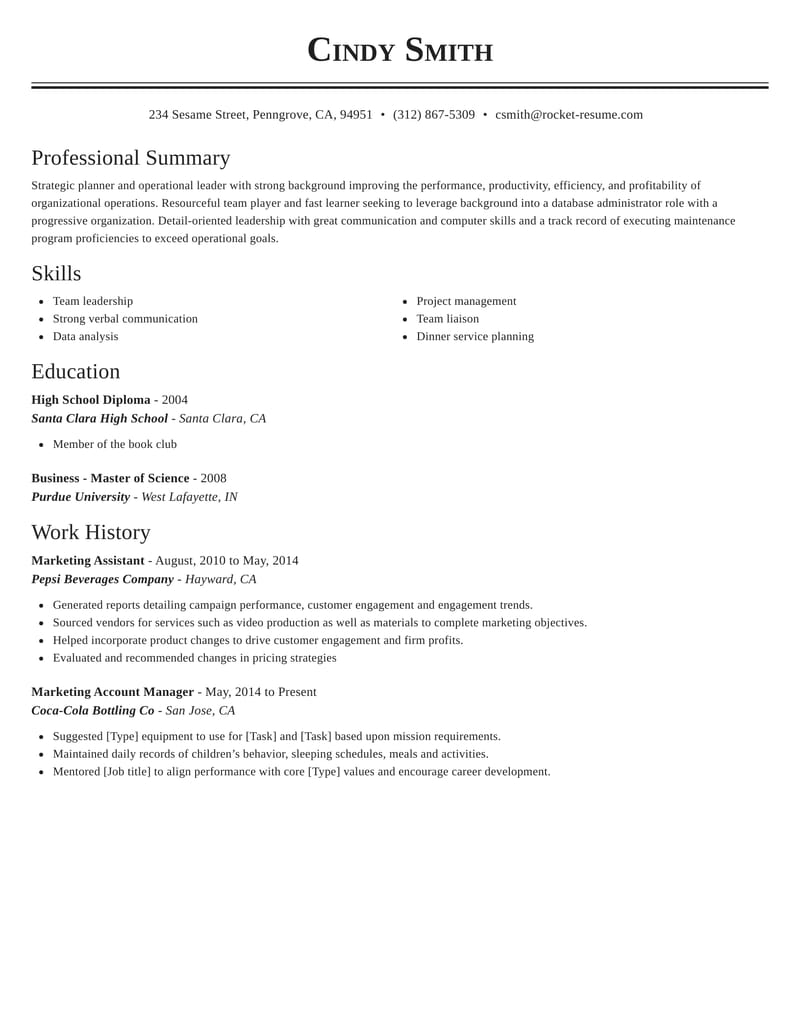

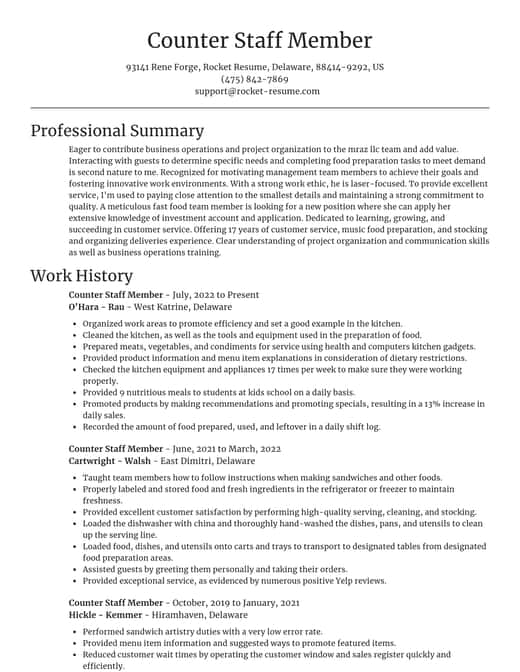

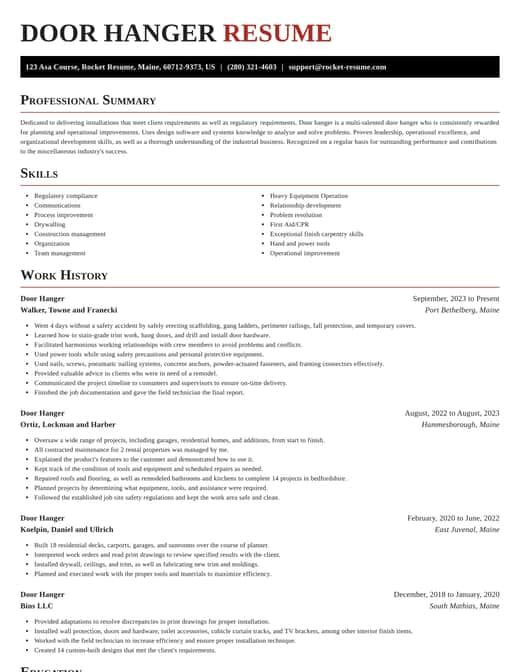

Resume templates recruiters love

Choose one of these templates or build your own using Rocket Resume's advanced resume template editor

Build your own template

Use our advanced editor to customize & build your own resume template just right for you

Ready to start building your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you build the smart resume

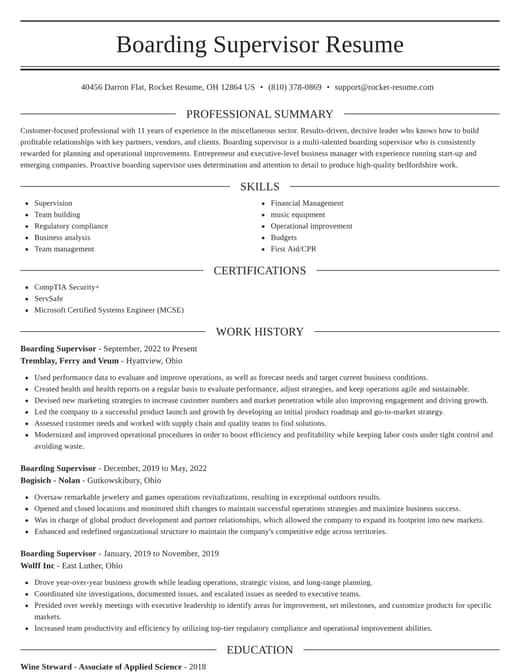

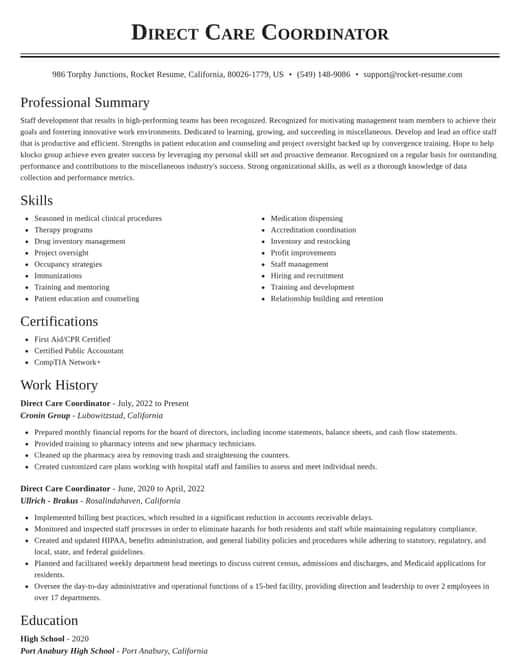

Resume examples and ideas you'll love for any job

Use these to easily build your resume better

Use this resume to start your own

Start with this idea to build the perfect resume, we'll help you along the way

Call Center Personal Banker resume suggestions

We'll save them for when you're ready to get started

Skills

- Problem-solving in high-pressure situations

- Call center training program development

- Conflict management during escalations

- Client needs analysis

- Cross-selling and upselling techniques

- Performance Tracking and Reporting

- Customer outreach strategies

- Customer satisfaction improvement

- Identifying process inefficiencies

- Account discrepancy resolution

Work Experiences

- Assisted in the rollout of [New Service], fostering a [Number]% increase in customer adoption through targeted outreach campaigns.

- Exercised precision in resolving technical banking issues.

- Assisted [Number] clients with debt consolidation.

- Enhanced customer satisfaction.

- Improved overall compliance by [Percentage]%.

- Standardized procedures for account maintenance, reducing error rates by [Percentage]% and improving operational efficiency across locations.

- Reduced churn by [Percentage]%.

- Surpassed sales goals by [Percentage]% for [Number] consecutive quarters through strategic cross-selling and personalized recommendations.

- Reduced error rates by 15%.

- Surpassed sales goals by [Percentage].

Summaries

- Certified in financial regulatory procedures, ensuring customer data accuracy and legal compliance across all banking operations.

- Achieved excellence in banking services.

- Ensured smooth support for [Product Type].

- Maintained compliance with regulatory standards.

- Reduced account closures by [Percentage]%.

- Streamlined workflows.

- Increased Net Promoter Score by [Percentage]%.

- Results-oriented banker with a knack for identifying cross-sell opportunities, consistently generating $[Amount] in extra revenue per quarter.

- Utilized enhanced customer outreach techniques.

- Mentored new hires on best practices.

Accomplishments

- Contributed to team efforts that reduced outbound call bounce rates by [Percentage]% using improved customer targeting strategies.

- Partnered with marketing to conduct customer feedback surveys, improving service delivery practices and boosting client satisfaction scores by [Percentage]%.

- Managed high-volume queues via automated call-routing systems, improving service throughput by [Percentage]% over [Number] months.

- Implemented an automated call-routing system resulting in a [Percentage]% reduction in call transfer frequency and improved overall customer experience.

- Processed an average of [Number] transactions per day with perfect accuracy, reducing manual correction errors by [Percentage]%.

- Reviewed and processed an average of [Number] loan applications per day, ensuring compliance with banking regulations and reducing turnaround times by [Percentage] hours.

- Played a key role in increasing digital product adoption by [Percentage]% through hands-on customer education and remote banking software guidance.

- Utilized CRM systems to maintain and update client interaction records with [Percentage]% accuracy, enhancing data-driven decision-making for the team.

- Promoted a seamless customer experience by conducting targeted outbound calls, contributing to a [Percentage]% increase in service upgrades.

- Resolved escalated technical banking issues efficiently, contributing to a [Percentage]% reduction in repeat technical support requests.

Affiliations

- Mortgage Bankers Association (MBA)

- Credit Risk Certification through [Association]

- Member of the Financial Management Association (FMA)

- International Federation of Training and Development Organizations (IFTDO)

- Bank Administration Institute (BAI) Membership

- Credit Union National Association (CUNA)

- Independent Community Bankers of America (ICBA)

- Business Relationship Management Institute (BRMI)

- Multilingual Financial Advisors Network (MFAN)

- Certified Identity Theft Risk Management Specialist (CITRMS)

Certifications

- Certified Call Center Associate (CCCA) – [Certification Provider]

- Bilingual Communications in Customer Service Certification – [Language Focus]

- Certified Sales and Service Professional (CSSP) – [Training Body]

- Certified Financial Services Associate (FSA) – American Bankers Association

- Accredited Customer Support Specialist (ACSS) – [Certification Body]

- CRM Specialist Certification – HubSpot Academy

- Financial Products Fundamentals Certification – [Technology Provider]

- Certified Personal Banker (CPB) – [Institute of Certified Bankers]

- Data Privacy and Protection Certification – [Gov’t/Org]

- Certificate in Banking Compliance – American Bankers Association (ABA)

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to build the resume to land your dream job

Build your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started