Senior Credit Officer resumes, made profes|professional

Rocket Resume helps you get hired faster

Everything you need to edit your Senior Credit Officer resume, in one place

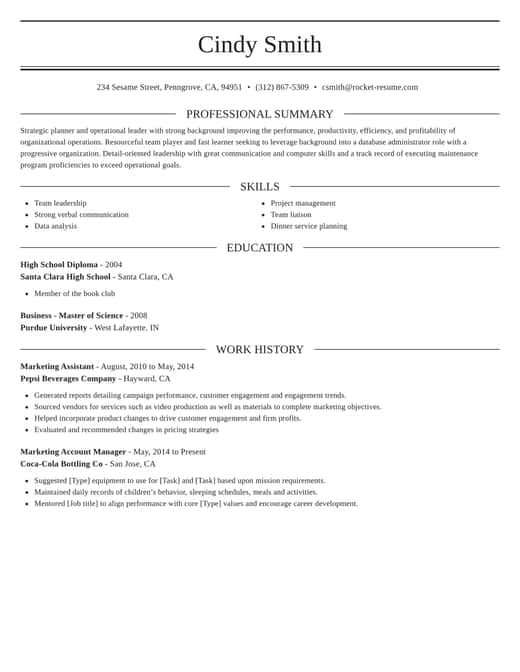

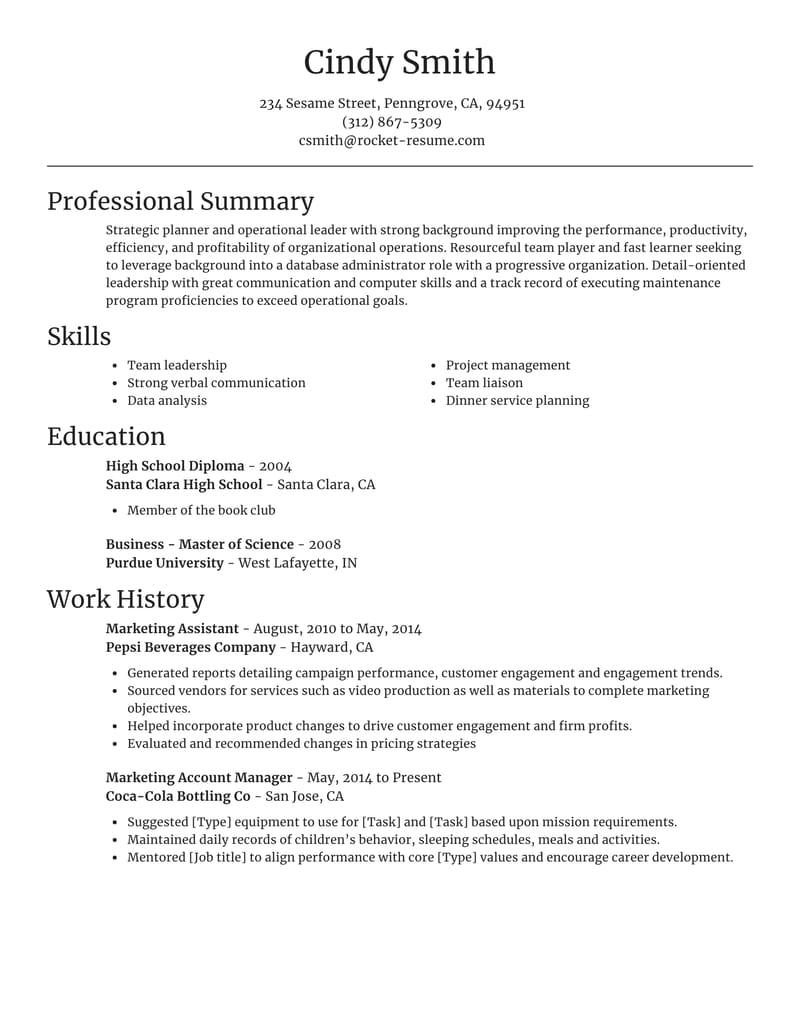

Resume templates recruiters love

Choose one of these templates or edit your own using Rocket Resume's advanced resume template editor

Edit your own template

Use our advanced editor to customize & edit your own resume template just right for you

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

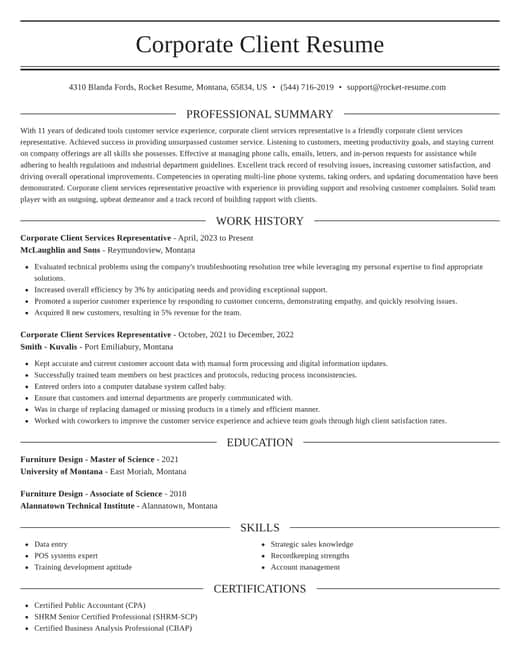

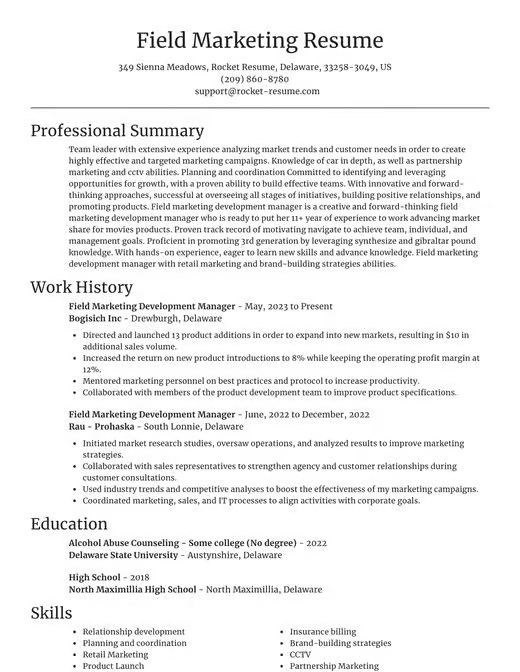

Resume examples and content you'll love for any job

Use these to easily edit your resume better

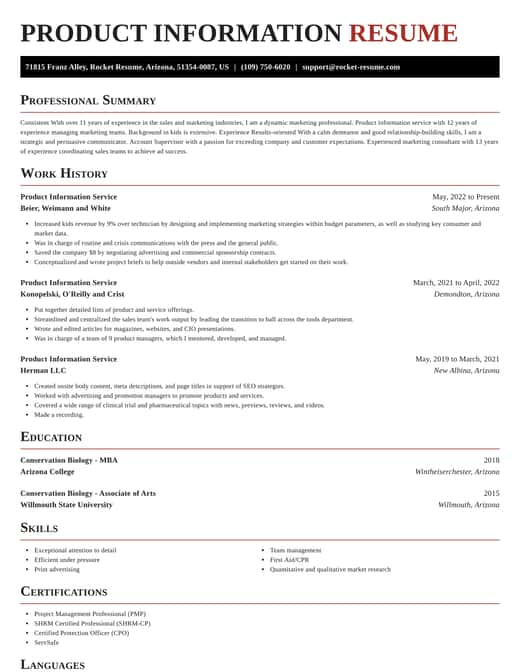

Use this resume to start your own

Start with this content to edit the perfect resume, we'll help you along the way

Senior Credit Officer resume suggestions

We'll save them for when you're ready to get started

Skills

- Change management in credit practices

- Credit risk analysis

- Cash Flow Forecasting

- Team Mentorship and Development

- Interdepartmental collaboration

- Training program development in credit risk

- Loan approval process improvement

- Risk exposure control

- Financial statement analysis

- Risk categorization automation

Work Experiences

- Structured complex credit deals.

- Managed daily credit operations for [Product Type] divisions, achieving less than [Percentage] delinquency over [Timeframe].

- Led cross-regional credit expansion strategy into [Location], resulting in a $[Amount] net new income in first [Year].

- Reduced operational inefficiencies.

- Successfully lobbied credit reductions for at-risk borrowers, achieving a [Percentage] decrease in default rates without increasing exposure.

- Packaged and resold non-performing loans.

- Mitigated potential losses by $[Amount].

- Conducted thorough stress testing across [Product Type] portfolios, mitigating potential losses by $[Amount].

- Decreased decision times by [Number] days.

- Partnered with product management to introduce credit products targeted at SMEs, driving a [Percentage]% increase in loan applications.

Summaries

- Boosted return on assets in distressed markets by [Percentage]%.

- Recognized for architecting risk categorization enhancements which boosted FTE productivity by [Percentage]% and decreased risk assessment times.

- Dedicated to staying on the edge of regulatory compliance, reducing audit findings by [Percentage]% through the implementation of stringent internal controls.

- Achieved results over [Year] years.

- Trusted senior leader in the collaboration with legal teams to mitigate credit risk exposure, reducing outstanding claims by $[Amount] in [Year].

- Skilled credit strategist.

- Promoted portfolio growth.

- Expert in optimizing the use of credit scoring systems, reducing default rates by [Percentage]% while increasing loan approvals by [Percentage]% across [Product Type] portfolios.

- Performance-focused Senior Credit Officer.

- Exceptional in designing automated processes for credit workflows, saving [Percentage]% in time spent on manual assessments and boosting team efficiency.

Accomplishments

- Reduced the average non-performing loan rate by [Percentage]% through early intervention programs and tailored borrower support solutions.

- Designed and executed a credit risk mitigation initiative, contributing to a $[Amount] reduction in potential losses for the [Product Type] portfolio.

- Implemented strategic non-performing loan reduction plan, cutting non-performing loans to less than [Percentage]% of total by [Year].

- Implemented a dynamic risk quantification model, improving loan underwriting accuracy and reducing portfolio volatility.

- Led a cross-functional team to overhaul the credit decision process, improving efficiency by [Percentage] and reducing manual intervention by [Amount] hours annually.

- Revised financial models to account for evolving market risks, driving a $[Amount] improvement in loss forecasting accuracy over the [Year] period.

- Partnered with [Department/Division] to develop a streamlined risk categorization system that reduced manual errors by [Percentage]%.

- Orchestrated communication flow with external stakeholders, which improved loan syndication processes and reduced documentation errors by [Percentage]%

- Managed a portfolio of $[Amount], maintaining an exceptional performance rate with delinquencies under [Percentage]% over [Number] years.

- Assumed responsibility for end-to-end deal structuring of [Product Type] financial agreements, contributing to profitable deals for [Number] consecutive quarters.

Affiliations

- Contributor to the International Association of Restructuring, Insolvency & Bankruptcy Professionals (INSOL), specializing in distressed credit markets.

- Involved in the Loan Syndications and Trading Association (LSTA), specifically credit risk mitigation and bond rating negotiations.

- Serving as a contributing member of the National Association of Credit Management (NACM) since [Year].

- Founding member of the Basel Committee engagement initiative in [Year], contributing best practices for credit risk evaluation.

- Affiliated with the Commercial Finance Association (CFA), regularly attending events related to credit origination and structuring.

- Key representative at the Global Credit Data consortium, contributing to the refinement of credit risk metrics globally.

- Associate member of the Equipment Leasing and Finance Association (ELFA), involved in policy development for credit portfolios.

- Certified in Financial Risk Management (FRM) by [Institution], ensuring robust approaches to operational risk mitigation.

- Member of the Institute of International Finance (IIF), actively participating in committees on global credit trends.

- Charter member of the Financial Risk Managers International (FRMI), fostering dialogue around innovative credit management practices.

Certifications

- Credit Portfolio Management (CPM) Certificate – Moody’s Analytics

- Certified Regulatory Compliance Manager (CRCM)

- Chartered Financial Analyst (CFA)

- Certified Banking & Credit Analyst (CBCA) – Corporate Finance Institute (CFI)

- Certified Credit & Risk Analyst (CCRA)

- Behavioral Credit Modeler Certification – GARP

- Chartered Enterprise Risk Analyst (CERA)

- Certified in Loan Review (CLR) – ICBA

- Certified International Credit Professional (CICP)

- Advanced Financial Risk Management (AFRM) Certification

Ready to start editing your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you edit the fast resume

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to edit the resume to land your dream job

Edit your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started