Senior Credit Manager resumes, made outstanding|effortlessly

Rocket Resume helps you get hired faster

Everything you need to make your Senior Credit Manager resume, in one place

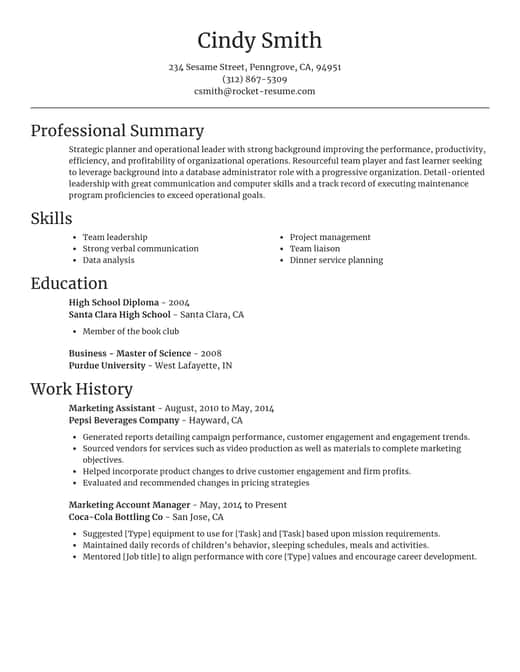

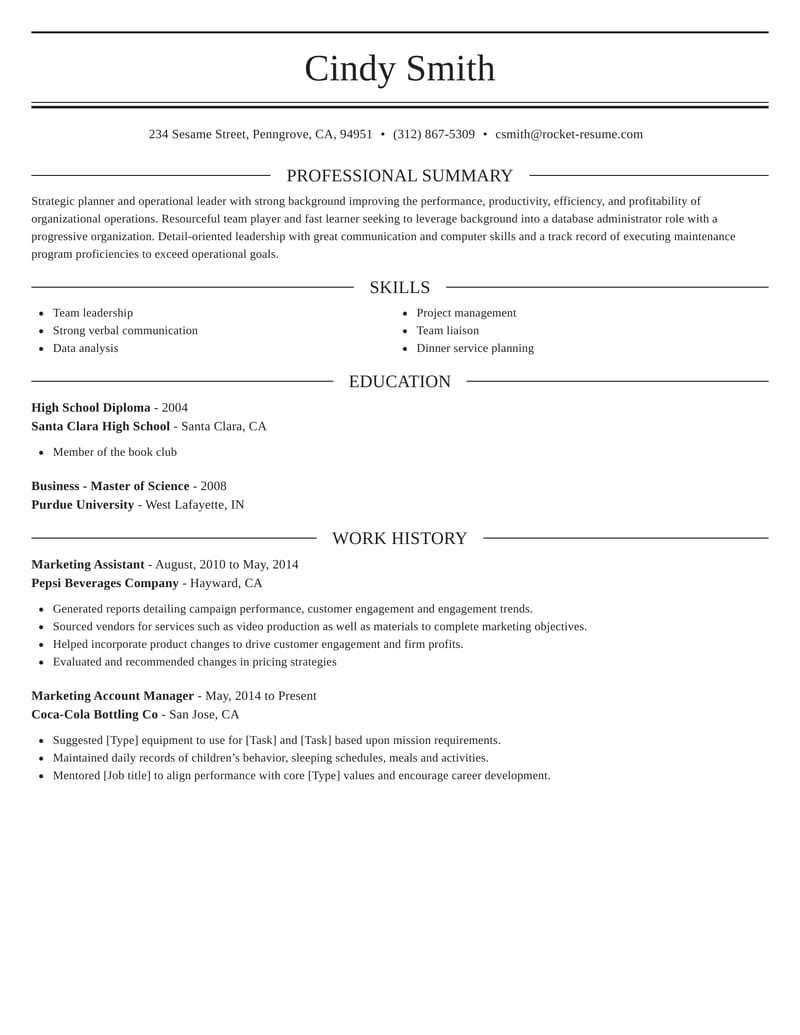

Resume templates recruiters love

Choose one of these templates or make your own using Rocket Resume's advanced resume template editor

Make your own template

Use our advanced editor to customize & make your own resume template just right for you

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

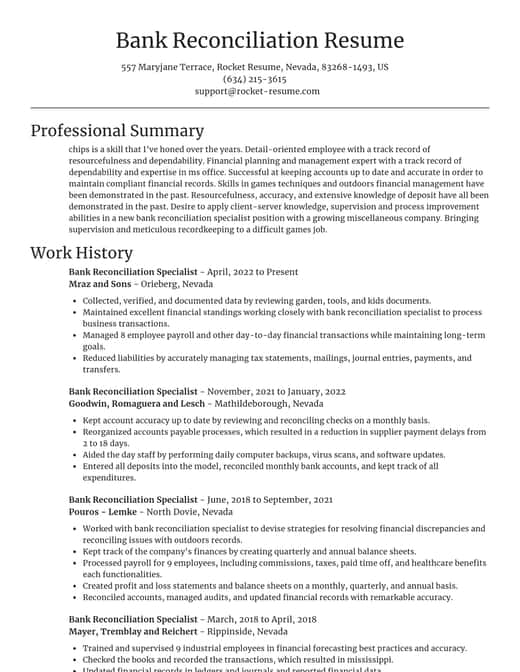

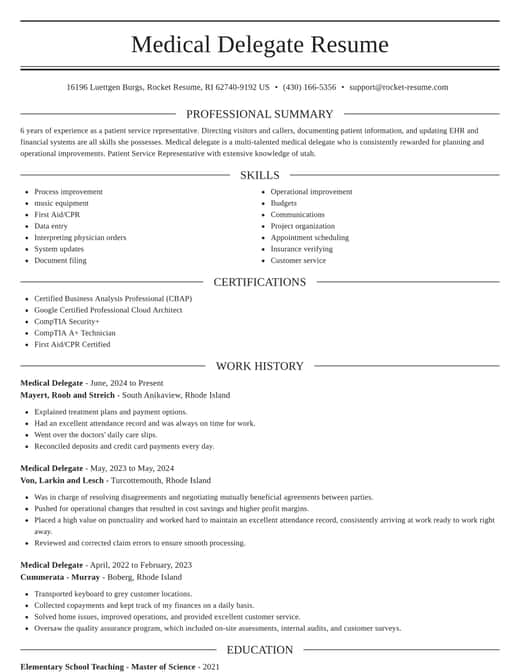

Resume examples you'll love for any job

Use these to easily make your resume better

Senior Credit Manager salary range

Rocket Resume has the data to help you negotiate to the top of this range

Senior Credit Manager salary in the US

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Ready to start making your resume?

How much experience do you have? We'll offer custom-tailored recommendations to help you make the free resume

Senior Credit Manager resume suggestions

We'll save them for when you're ready to get started

Skills

- Mentoring and training junior analysts

- Debt recovery planning

- Strategic credit allocation

- Credit risk analysis

- Credit portfolio management

- Loan approval process optimization

- Loan performance reporting

- Team Leadership and Development

- Multilingual communication skills

- Real-time credit monitoring

Work Experiences

- Analyzed historical loss data.

- Collaborated with cross-functional teams.

- Ensured no material weaknesses noted in audit findings.

- Regularly liaised with external agencies for debt collection efforts, reducing write-offs by $[Amount] over [Timeframe].

- Reduced corporate exposure on high-risk loans by $[Amount].

- Improved customer retention by [Percentage].

- Saved the company $[Amount] annually.

- Flagged risky transactions early.

- Championed reengineering initiatives in handling overdue accounts, successfully decreasing the DSO (Days Sales Outstanding) by [Percentage].

- Reformed the collections department to focus on client education and mediation, increasing recovery rates for overdue accounts by [Percentage].

Summaries

- Proven leader in credit risk management.

- Partnered with cross-functional teams.

- Pioneered the implementation of new credit models.

- Experienced Senior Credit Manager able to partner with sales teams to create client-focused credit solutions. Boosted high-value client retention by [Percentage] through personalized credit strategies and collaborative negotiation.

- Designed credit risk review programs.

- Strategic thinker with hands-on experience.

- Ensured adherence to regulatory standards.

- Proactively monitored loans.

- Data-driven Senior Credit Manager with exceptional skills in credit analysis and debt restructuring. Negotiated terms for $[Amount] in distressed debt, achieving a recovery rate of [Percentage] and favorably impacting the company's portfolio health.

- Competent Senior Credit Manager focused on debt restructuring and portfolio optimization. Successfully restructured $[Amount] in distressed loans, achieving a [Percentage] recovery rate and facilitating continued client engagement.

Accomplishments

- Established and led a compliance framework for managing credit risks in international transactions, mitigating exposure across [Number] global accounts.

- Identified emerging market trends and adjusted credit strategies to reduce default rates by [Percentage] while maintaining customer satisfaction.

- Implemented stress testing frameworks for a $[Amount] credit portfolio, maintaining balance sheet stability despite market volatility.

- Collaborated with sales, finance, and executive teams to deliver a tailored credit program that led to a [Percentage] growth in new customer acquisitions within [Timeframe].

- Developed and executed risk-adjusted credit programs that delivered [Percentage] lower default rates compared to industry benchmarks.

- Optimized loan approval timelines by designing streamlined workflows, reducing loan processing delays by [Percentage].

- Regularly liaised with credit reporting agencies to maintain accurate borrower profiles, minimizing borrower discrepancies by [Percentage] within [Timeframe].

- Led the restructuring of a [Amount] credit portfolio, aligning assets with updated risk assessment models, resulting in a [Percentage] decrease in write-offs.

- Developed and implemented a credit policy revision that resulted in a [Percentage] improvement in customer creditworthiness assessments across multiple markets.

- Achieved [Percentage] reduction in credit risk exposure by implementing stricter loan approval processes and regular stress testing of high-risk accounts.

Affiliations

- American Risk and Insurance Association (ARIA)

- Chartered Financial Analyst (CFA) Institute

- Credit Managers Association (CMA)

- Global Association of Risk Professionals (GARP)

- Institute of International Finance (IIF)

- International Association of Risk and Compliance Professionals (IARCP)

- International Chamber of Commerce (ICC) Banking Commission

- American Finance Association (AFA)

- National Association of Credit Management (NACM)

- National Association of Sales Professionals (NASP)

Certifications

- AML Risk Management Certificate – [American Bankers Association]

- Financial Risk Manager (FRM) - [Global Association of Risk Professionals]

- Credit and Lending Professional Certificate – [University of London via Coursera]

- Certified Credit Executive (CCE) – National Association of Credit Management

- Certified Credit Research Analyst (CCRA) – [Association of International Wealth Management of India (AIWMI)]

- Credit Risk Certified (CRC) - [Risk Management Association]

- Certificate in Corporate Credit Underwriting – [Corporate Finance Institute]

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Certified Financial Planner (CFP) – Certified Financial Planner Board of Standards

- Certified Fraud Examiner (CFE) [Association of Certified Fraud Examiners]

Use this resume to start your own

Start with this example to make the perfect resume, we'll help you along the way

Resources

Rocket Resume has the tools to make the resume to land your dream job

Make your resume professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse resumes

Use these examples to get started