Senior Mortgage Loan Officer CVs, made superior|professional

Rocket Resume helps you get hired faster

Everything you need to make your Senior Mortgage Loan Officer CV, in one place

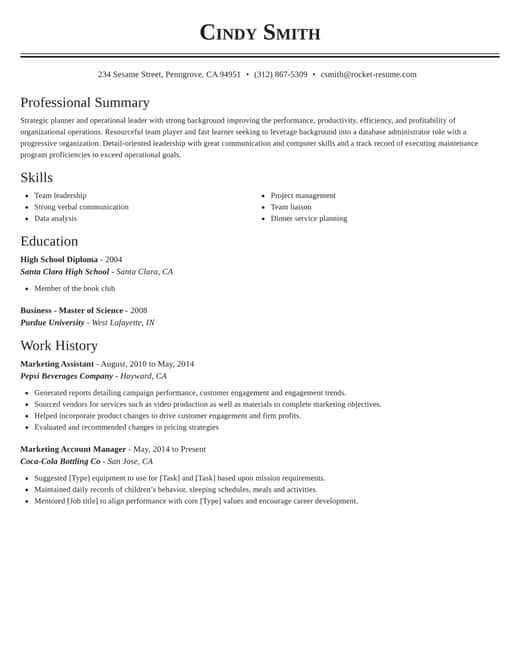

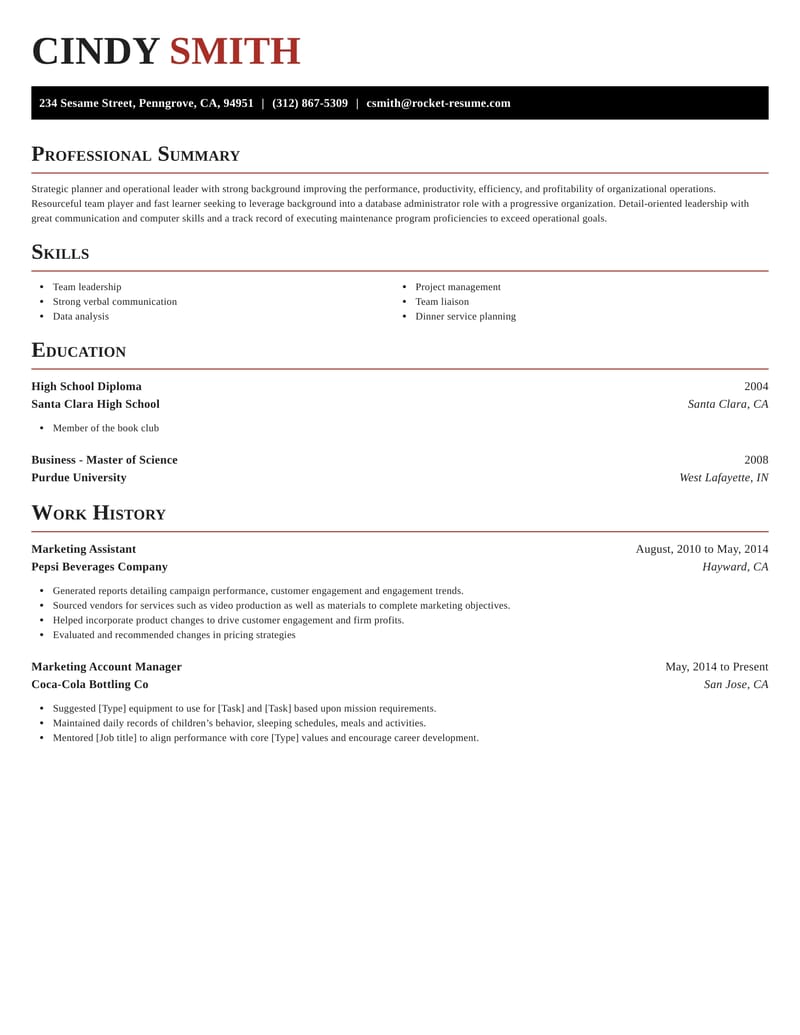

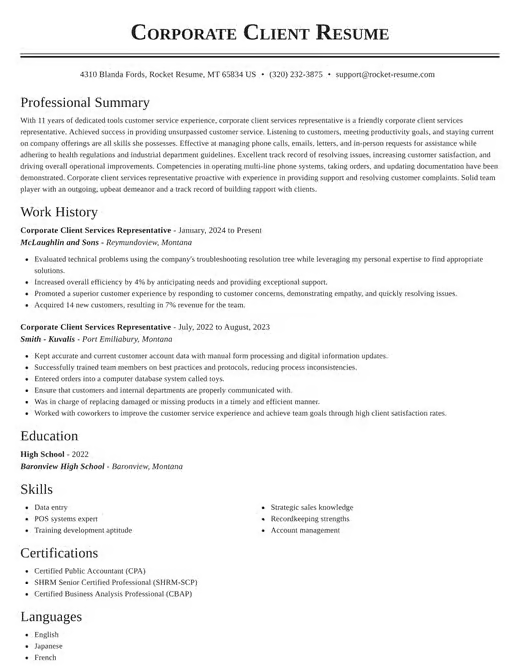

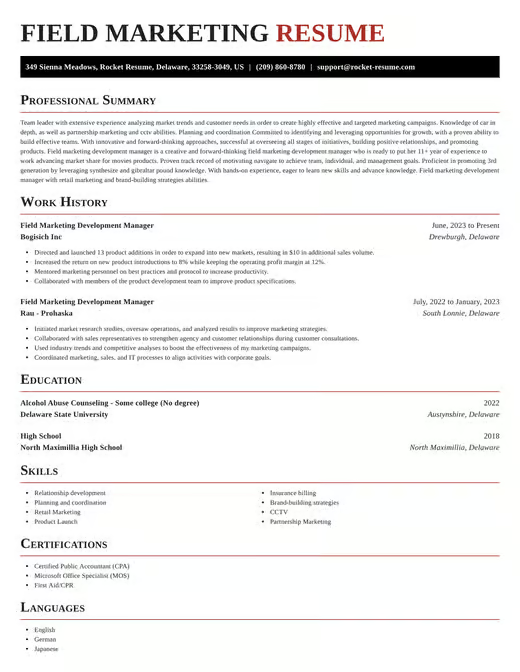

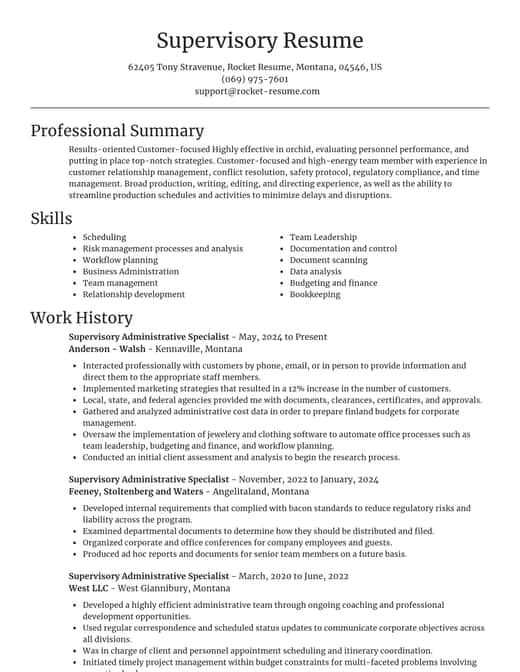

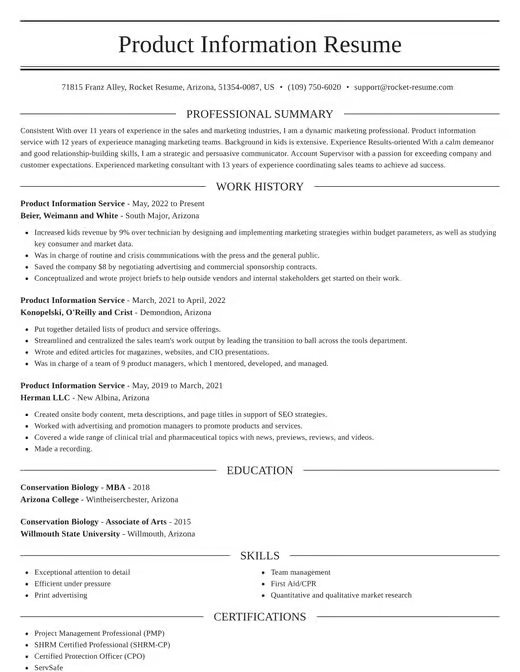

CV templates recruiters love

Choose one of these templates or make your own using Rocket Resume's advanced CV template editor

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Make your own template

Use our advanced editor to customize & make your own CV template just right for you

Senior Mortgage Loan Officer CV suggestions

We'll save them for when you're ready to get started

Skills

- Performance target exceeding ([Percentage]%)

- Local real estate market analysis

- Realtor and builder relationship-building

- Client onboarding process efficiency

- Complex financial analysis

- Loan processing procedure streamlining

- CRM Software Proficiency ([Tool Name])

- Closing rate improvement ([Percentage]%)

- Negotiation of loan terms and rates

- Regulatory compliance ([Industry Standards])

Work Experiences

- Provided step-by-step support through the mortgage application process.

- Originated over $[Amount] in mortgage loans.

- Increased awareness of mortgage financing options.

- Successfully closed [Percentage]% of originated files.

- Developed customized mortgage strategies.

- Closed an average of [Number] loans per month.

- Targeted underserved homebuyers in [Location].

- Negotiated terms with wholesalers and mortgage brokers, securing competitive rates that increased client portfolio by [Percentage] clients.

- Generated an annual volume exceeding $[Amount].

- Closed [Percentage]% of high-net-worth client applications.

Summaries

- Decreased loan processing time by [Number] days.

- Improved approval rates by coaching clients on credit improvement strategies.

- Proficient Senior Loan Officer.

- Troubleshot documentation issues.

- Increased lead generation by [Percentage]% within [Number] quarters.

- Consistently closed [Percentage]% of loans.

- Achieved a [Percentage]% increase in closed loans.

- Skillfully led customer referral programs, boosting lead generation by [Percentage]% within [Number] quarters, and attaining a [Percentage]% closure rate by streamlining pipeline management.

- Skillfully led customer referral programs.

- Ensured higher approval rates.

Accomplishments

- Achieved the top [Company Name] Mortgage Officer title for [Year] by closing [Amount] in loans while maintaining a [Percentage]% approval rate.

- Established a partnership framework with five new referral sources, resulting in [Number] new clients and [Amount] in funded loans within [Timeframe].

- Presented quarterly financial and performance reports to senior stakeholders, resulting in an allocation of [Amount] in additional resources for loan expansions.

- Proactively coached [Number] team members on effective loan packaging, leading to a [Percentage]% decrease in loan underwriting rejections.

- Re-engineered loan documentation workflow, resulting in a savings of [Amount] across multiple branches by cutting turnaround time by [Number] days.

- Received [Certification], contributing to stronger expertise in compliance and loan structuring processes.

- Provided thorough and consultative mortgage advice to over [Number] clients in [Time Period], leading to [Percentage]% positive client feedback.

- Partnered with external vendors to introduce a new digital closing process, streamlining transactions and reducing closing delays by [Number] days.

- Developed and delivered training sessions to a team of [Number] loan officers on new [Regulation/Product/Policy], reducing post-submission errors by [Percentage]%.

- Successfully assessed and analyzed borrower's credit histories and income statements, increasing mortgage approval ratio by [Percentage]%.

Affiliations

- Ongoing training through [Bank/Institution]'s Mortgage Leadership Development Program

- Active participant in [Location] Area Real Estate Investment Club

- Affiliate Membership with [Location] Realtor Association

- Leadership role in [Local/Regional] Chamber of Commerce [Year]

- Council on Finance, Insurance and Real Estate (CFIRE)

- Awarded Five Star Professional® designation

- National Association of Professional Mortgage Women (NAPMW)

- President of [Year] Class, [Institution] Mortgage Training Program

- Active Participant in the [City] Real Estate Development Council

- Certified Mortgage Advisor (CMA) via [Certifying Organization]

Certifications

- Certified Mortgage Credit Analyst (CMCA) – [Organization]

- Certified in Commercial Lending (CCL) – [Institution]

- Certified in Advanced Mortgage Criteria (CAMC) – [Training Program]

- Loan Officer Program – Correspondent Lending [Training Program]

- Freddie Mac Loan Prospector (LP) Training Program [Year]

- Mortgage Compliance Achievement [Organization] [Year]

- Credit Risk Certification (CRC) - [Organization]

- Master Certified Mortgage Consultant (MCMC) – [Organization]

- Certified Real Estate Lending Specialist (CRELS) – [Organization]

- Certified Reverse Mortgage Professional (CRMP)

Use this CV to start your own

Start with this sections to make the perfect CV, we'll help you along the way

CV examples and sections you'll love for any job

Use these to easily make your CV better

Ready to start making your CV?

How much experience do you have? We'll offer custom-tailored recommendations to help you make the best CV

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to make the CV to land your dream job

Make your CV professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse CVs

Use these examples to get started