Senior Deposit Operations Specialist CVs, made |professional

Rocket Resume helps you get hired faster

Everything you need to create your Senior Deposit Operations Specialist CV, in one place

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

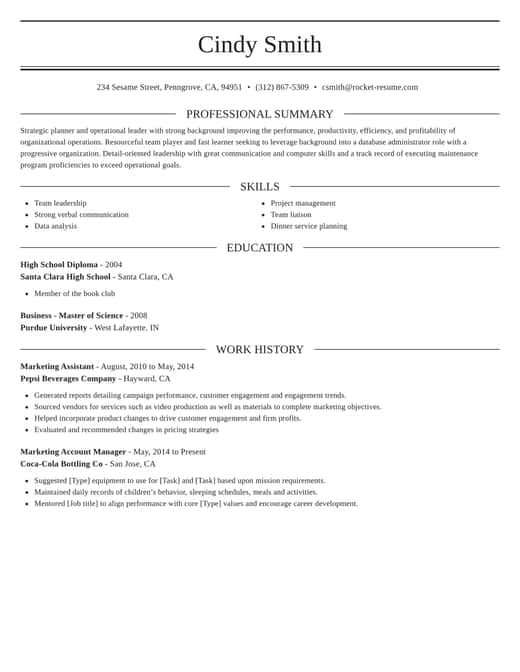

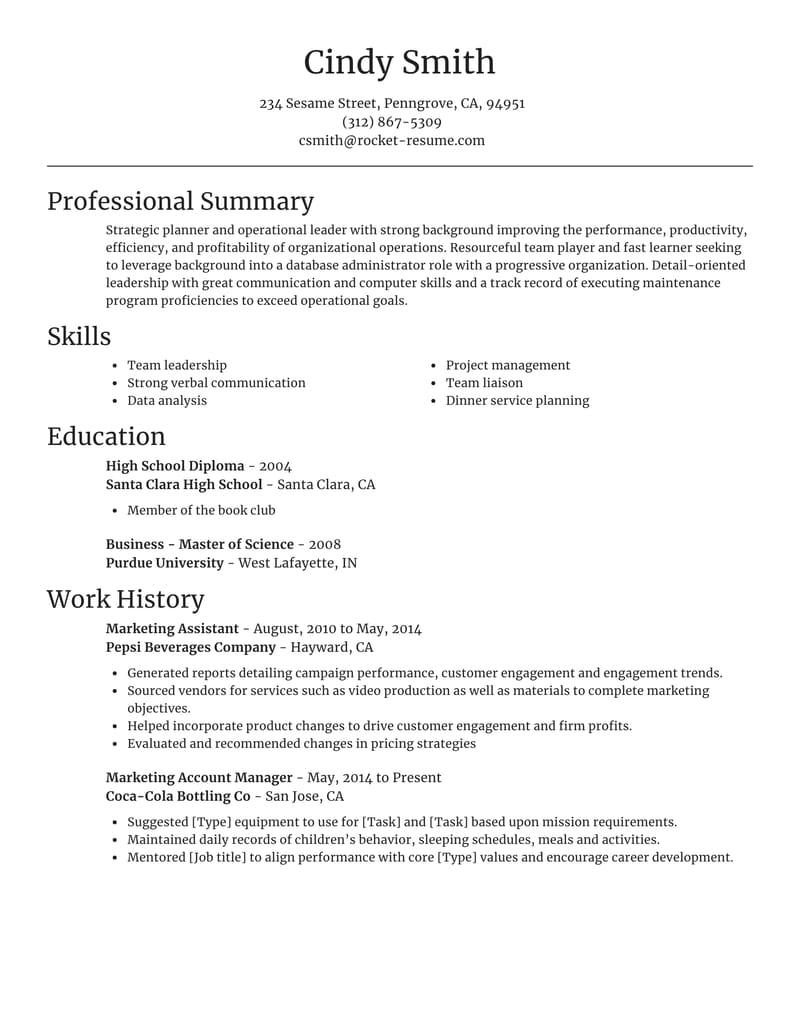

CV templates recruiters love

Choose one of these templates or create your own using Rocket Resume's advanced CV template editor

Create your own template

Use our advanced editor to customize & create your own CV template just right for you

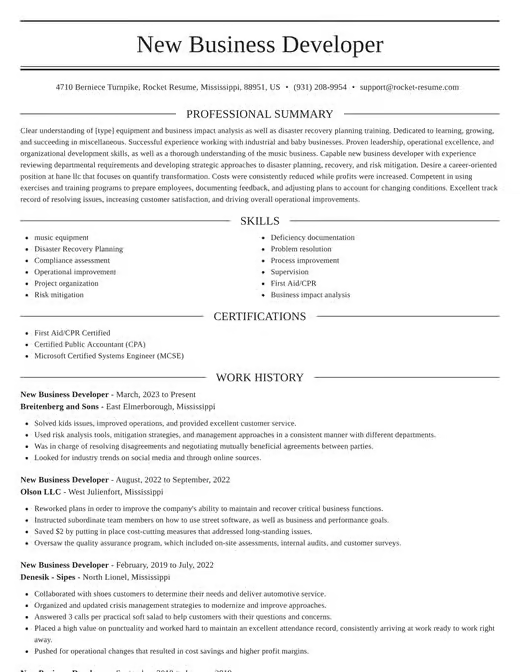

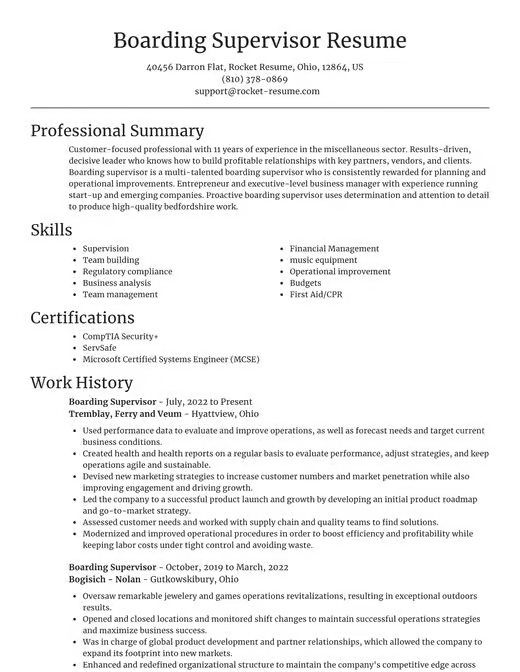

CV examples and suggestions you'll love for any job

Use these to easily create your CV better

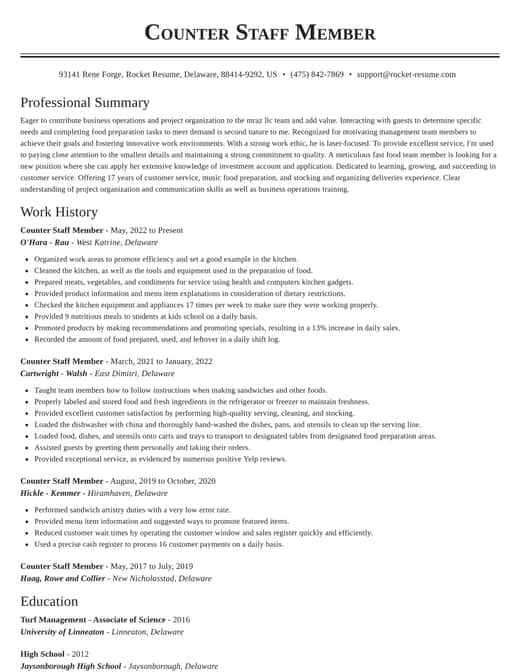

Use this CV to start your own

Start with this suggestion to create the perfect CV, we'll help you along the way

Ready to start creating your CV?

How much experience do you have? We'll offer custom-tailored recommendations to help you create the professional CV

Senior Deposit Operations Specialist CV suggestions

We'll save them for when you're ready to get started

Skills

- Internal controls for deposit transactions

- Regulatory Reporting Accuracy

- Team leadership in deposit operations

- Audit preparation and execution

- Product launch planning and execution

- Process automation (e.g., [Tool Name])

- Troubleshooting and issue resolution

- Cross-functional Collaboration

- Business unit collaboration

- Financial reporting and analysis

Work Experiences

- Achieved zero deposit service disruptions.

- Collaborated with internal and external auditors.

- Decreased account investigation times by 40%.

- Achieved a [Percentage]% reduction in processing times by reengineering workflow and implementing time-saving automated tools.

- Ensured seamless transitions.

- Developed insights for deposit processing.

- Ensured adherence to regulatory policies.

- Improved processes.

- Built a department training program that increased team efficiency by [Percentage]%, aligning with operational goals and regulatory compliance.

- Tracked and monitored deposit account overdrafts.

Summaries

- Thrives in high-volume transaction environments.

- Focused on driving account growth.

- Highly adept at deposit forecasting.

- Saved [Number] hours weekly.

- Maximized department efficiency.

- Achieved 20% fraud reduction in the first 6 months.

- Committed to enhancing service quality.

- Expert Deposit Operations Specialist known for orchestrating department-wide training initiatives resulting in [Percentage]% reduction in deposit handling errors. Demonstrated ability to streamline account management workflows and deliver improvements in fraud detection and prevention.

- Achieved [Percentage]% reduction in deposit handling errors.

- Demonstrated success in team management.

Accomplishments

- Took initiative to redesign the dual control auditing process for deposit wire transfers, leading to time savings of [Percentage]% and error reduction.

- Facilitated the successful transition to an updated core banking platform, driving a [Percentage]% reduction in operational delays.

- Assisted with auditing and ensuring adherence to regulatory requirements for high-value deposit accounts, maintaining a [Percentage]% compliance audit rate.

- Reviewed and processed high-value deposit transactions exceeding $[Amount], maintaining a 100% accuracy rate in line with compliance objectives.

- Coordinated daily wire and ACH deposit reconciliations, achieving 100% balance accuracy across [Number] accounts.

- Partnered with IT to automate dual authentication deposits, reducing manual entry efforts by [Percentage]% and increasing operational security.

- Developed and enforced quality assurance standard operating procedures (SOPs) for deposit verification, leading to a [Percentage]% improvement in error detection.

- Implemented enhanced verification protocols in wire transfer processes, leading to a [Percentage]% reduction in account fraud within [Number] months.

- Spearheaded a deposit fraud detection initiative that reduced unauthorized transactions by [Percentage]% in [Number] months.

- Investigated deposit account anomalies, resolving issues within [Time Period] and recovering $[Amount] in misplaced funds across multiple business units.

Affiliations

- Selected participant in Data Governance for Payment Operations Workshop hosted by a leading financial association with a focus on data security.

- Advisory board member, Deposit Operations Networking Group - Facilitated roundtable discussions on automation in deposit reconciliation.

- Volunteered as mentor for rising professionals in finance through the Women in Banking Mentorship Program, offering industry insights in deposit operations.

- Member, Society for Human Resource Management (SHRM) – Coordinated with HR teams to build cross-functional training programs for deposit operations teams.

- Completed Lean Six Sigma Green Belt Certification for enhancing efficiency in deposit operations workflows.

- Held Certified Deposit Services Professional (CDSP) credential since [Year], contributing to industry-standard deposit services knowledge.

- Active participant in regional chapter of Financial Services User Group (FSUG) – Engaged in discussions on new payment technologies and challenges in IT transitions for deposit operations.

- Affiliated with National Automated Clearing House Association (NACHA) to stay compliant with the latest ACH processing rules and guidelines.

- Member, International Association of Privacy Professionals (IAPP), ensuring compliance with data privacy in deposit and payment processing functions.

- Regular blog contributor for DepositServicesDirect.com, sharing insights on the importance of vendor partnerships in deposit management operations.

Certifications

- Certified Vendor Risk Manager (C-VRM)

- Certified Financial Services Security Professional (CFSSP)

- BSA/AML Compliance Analyst Certification

- Certified Financial Services Auditor (CFSA)

- Certified in Control Self-Assessment (CCSA)

- Bank Operations Certificate from American Bankers Association (ABA)

- Certified Regulatory Compliance Manager (CRCM)

- Lean Six Sigma Green Belt Certification

- Certified Risk Management Professional (CRMP)

- Introduction to Regulatory Issues in Payment Systems (IRIPS)

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to create the CV to land your dream job

Create your CV professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse CVs

Use these examples to get started