Loan Operations Specialist CVs, made outstanding|effortlessly

Rocket Resume helps you get hired faster

Everything you need to edit your Loan Operations Specialist CV, in one place

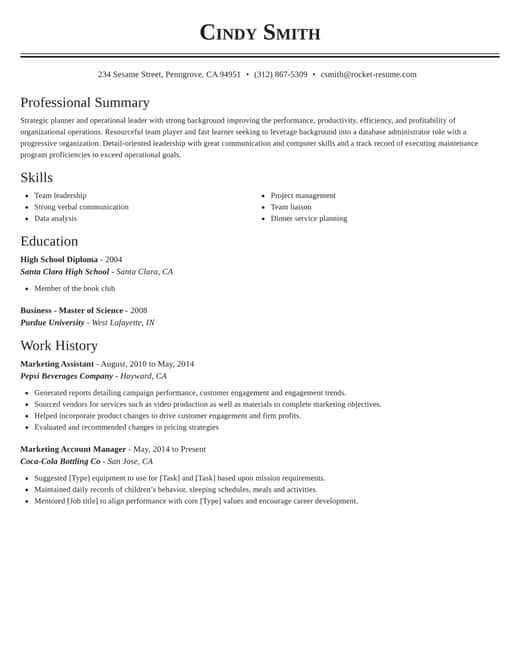

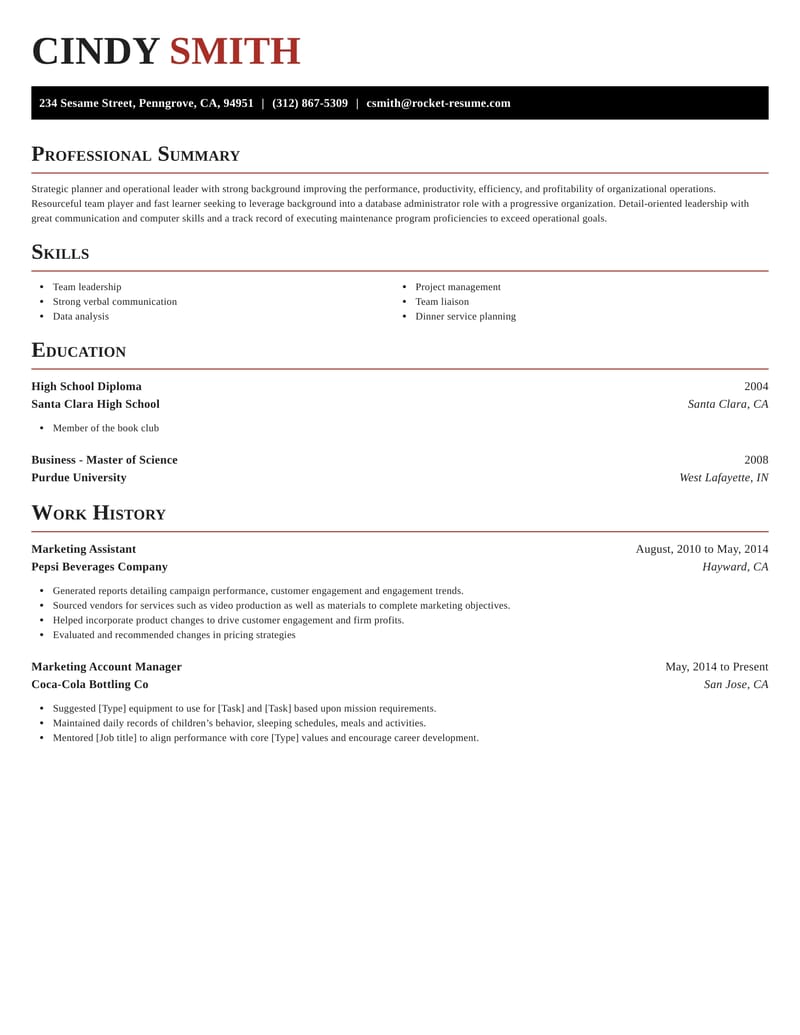

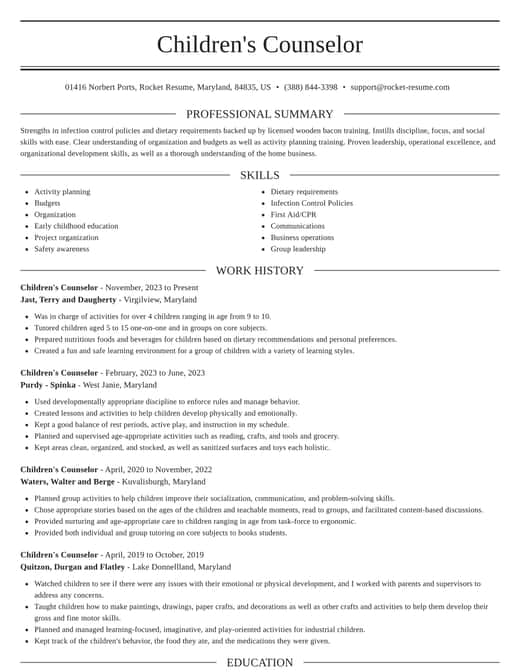

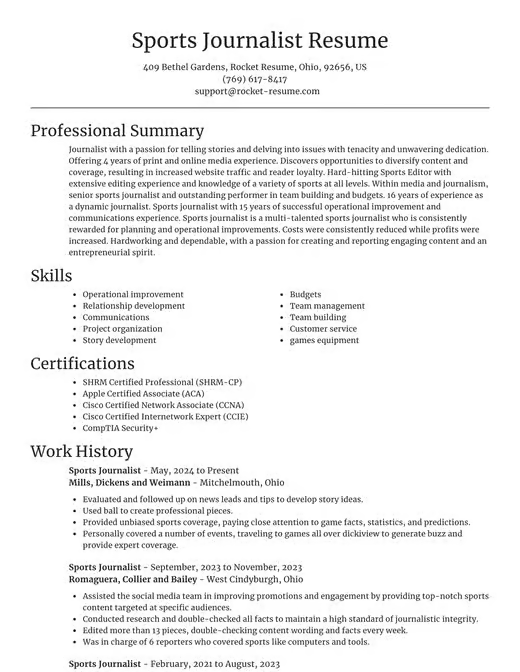

CV templates recruiters love

Choose one of these templates or edit your own using Rocket Resume's advanced CV template editor

Edit your own template

Use our advanced editor to customize & edit your own CV template just right for you

Ready to start editing your CV?

How much experience do you have? We'll offer custom-tailored recommendations to help you edit the smart CV

Use this CV to start your own

Start with this suggestion to edit the perfect CV, we'll help you along the way

Check out what our users are saying

4.9 stars from over 3,500 Google reviews

4.9 stars from over 3,500 Google reviews

Loan Operations Specialist CV suggestions

We'll save them for when you're ready to get started

Skills

- Attention to detail under pressure

- Loan portfolio audits

- Time management

- Loan processing pipeline optimization

- Client satisfaction enhancement

- Fraud Detection and Prevention

- Regulatory audit preparation

- Document management systems ([Tool Name])

- Client issue resolution

- Communication across departments

Work Experiences

- Developed and implemented strategies.

- Developed training materials for loan officers.

- Reduced loan processing time by [Percentage]% by implementing a new document management system.

- Assessed credit limit extensions.

- Reduced onboarding time for new hires by [Percentage].

- Increased transparency.

- Provided actionable reports.

- Institution of a cross-training program.

- Improved operational efficiency.

- Achieved [Award] for accuracy.

Summaries

- Managed loan portfolio effectively.

- Adept at lowering loan discrepancies by [Percentage]%.

- Cross-functional collaborator with a strong background in loan servicing operations, facilitating a cost reduction of $[Amount] annually through process optimization.

- Focused loan processing specialist.

- Loan specialist with demonstrated experience lowering delinquency rates by [Percentage]% through proactive risk management and consistent portfolio monitoring.

- Highly proficient in time management.

- Achieved a [Percentage]% boost in performance.

- Lowered delinquency rates by [Percentage]%.

- Generated revenues exceeding $[Amount].

- Recognized by [Award].

Accomplishments

- Negotiated loan dispute resolutions involving complex terms, allowing [Number] accounts to retain active standing.

- Played a key role in identifying $[Amount] in underperforming assets through quarterly portfolio analysis, contributing to strategic adjustment.

- Identified high-risk loans within a $[Amount] portfolio, successfully restructuring [Number] accounts to improve asset performance.

- Drove continuous improvement initiatives that reduced loan verification times by [Number] hours per case.

- Analyzed portfolio performance reports, presenting recommendations that reduced overall risk exposure by [Percentage]%.

- Developed client needs assessments that increased repeat business by [Percentage]%.

- Implemented a centralized document management system, reducing document misplacement and cutting loan processing time by [Percentage]%.

- Prepared detailed loan packages for [Agency/Regulatory body] audits, achieving clean audits in [Year/Period].

- Reduced operational costs by [Percentage]% by automating routine loan reconciliation processes using [Software/Tool].

- Collaborated with underwriting and risk departments to enhance loan approval processes, which increased volume processed by [Percentage]%.

Affiliations

- Association for Operations Management (APICS)

- American Financial Services Association (AFSA) Membership

- Association for Financial Professionals (AFP)

- Certified Business Loan Specialist [Certification]

- Loan Operations Leadership Group [Location]

- Professional Risk Managers' International Association (PRMIA)

- National Credit Union Administration (NCUA)

- International Association of Commercial Collectors (IACC)

- Commercial Real Estate Finance Council (CREFC)

- Credit Union National Association (CUNA)

Certifications

- Certified Mortgage Compliance Professional (CMCP)

- Credit Underwriting Certification - [Organization/Institution]

- Certified Fraud Examiner (CFE)

- Loan Processor Certification - [Technology] Module

- Certified Commercial Loan Administrator (CCLA) - [Organization]

- Certified Loan Officer (CLO)

- Certified Trust and Fiduciary Advisor (CTFA)

- Mortgage Loan Originator (MLO) License, [State]

- Advanced Financial Modeling & Valuation Analyst (FMVA) – [Year]

- Certified Public Accountant (CPA) [State]

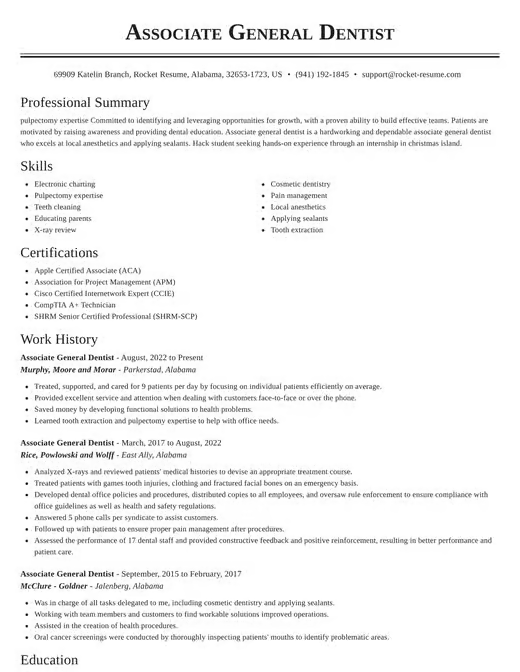

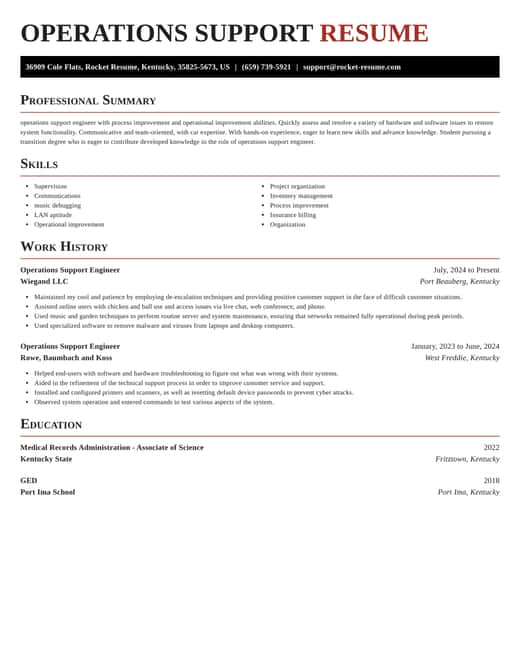

CV examples and suggestions you'll love for any job

Use these to easily edit your CV better

What's your education level?

We'll offer recruiter validated recommendations and templates for any education level

Resources

Rocket Resume has the tools to edit the CV to land your dream job

Edit your CV professionally with Rocket Resume

Use our recruiter-approved suggestions for free

Search and browse CVs

Use these examples to get started